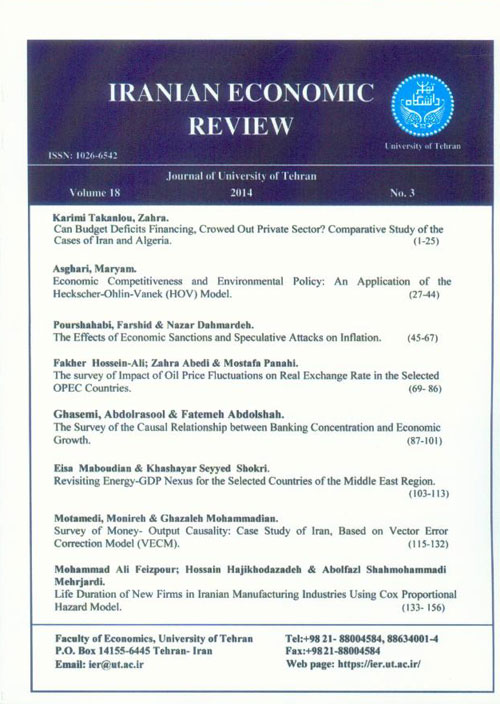

فهرست مطالب

Iranian Economic Review

Volume:18 Issue: 38, Autumn 2014

- تاریخ انتشار: 1394/06/23

- تعداد عناوین: 8

-

-

Pages 1-25This paper develops an analysis of budget deficit financing in terms of a crowding out or crowding in effect on the activity of the private sector for the economies of Iran and Algeria as two MENA countries, (because of its economic structures (dependence on oil revenue)) during the period 1970-2012 by using Cointegration and Vector Error Correction approaches. The analysis confirms the existence of a crowding out effect in Algeria and a crowding in effect in Iran.Keywords: Budget Deficit, Private Sector, Crowding out or Crowding in Effects, Cointegration, VECM (Vector Error Correction Model)

-

Pages 27-44The relationship between trade liberalisation and the environment has been the subject of a growing body of literature in recent years. As can be seen from the differing assessment of instrument types for environmental protection, one of the important factors for the relationship between environmental protection and economic competitiveness are regulatory stringency and efficiency. This concerns e.g. performance versus ambient standards, sale technology versus clean technology/clean production, process change versus demand side measures, legislation versus economic instruments. The model based on the Heckscher-Ohlin-Vanek (HOV) model and I focus on the issue of whether environmental regulations influence patterns of the nine Mediterranean developed countries region’s international trade over 2000–2013. The results indicate that more environmental policy stringency in the region decrease net exports.Keywords: environmental regulation, Trade, Heckscher, Ohlin, Vanek (HOV) model, Mediterranean region

-

Pages 45-67This paper surveys the persian monetary crises due to economic sanctions and speculative attacks that leads to high inflation. Economic sanctions are associated with various forms of trade barriers and restriction on financial transactions. Among the most influential sanctions on Iran''s oil export and central bank sanctions are noted that their Aims to reduce Iran''s oil revenues and Devaluation of the national currency of Iran. New economic sanctions have greatest effect on foreign currency transactions and foreign currency speculative attacks can lead to devaluation of the national currency to be stimulated inflationary pressures. This study introduced a new inflation function based on Neo-Keynesian framework in the case of oil exporting counties. Also dynamics of speculative attacks based on Markov Regime-Switching GARCH (MRS-GARCH) model is used to capture some of the exchange rate dynamics associated with the speculative attacks. The results of co-integration vector estimation using the FMOLS approach indicated that speculative attacks have positive effect on inflation but sanctions affect inflation indirectly through speculative attacks, stagnation, currency crisis, expected inflation and etc.Keywords: Economic Sanctions, Speculative Attacks, Inflation

-

Pages 69-86One of the most significant discussion and challenges propounded in the macroeconomics is the effects of fluctuations of exchange rate on the macroeconomic variables (production, employment, inflation and … etc).In this direction, the important and noticeable point is the factors which lead to fluctuations in the exchange rate which, from amongst these factors as an example, is fluctuations in the oil price. For this reason, relationship between oil price fluctuation and exchange rate seems to be important and necessary. Time period used in this study relates to the years from 1990 to 2010. Also, Autoregressive Distributed Lag Model (ARDL) has been used to study relationship among the variables. Results obtained from this study show the negative and significant effect of oil price fluctuations on the exchange rate. A negative and significant quantity was obtained from ECM coefficient, and this problem represents activeness of the model from short-term to long-term. The oil price changes have left asymmetrical effects on the countries in the short term, and these effects will continue in the long term as well. Of course, direction of short term effects, contrary to the long term effects, is in each level.Keywords: Oil Price Fluctuation, Real Exchange Rate, Auto, Regressive Distributed Lag Model (ARDL)

-

Pages 87-101This paper examines the causality between concentration in banking industry and economic growth by using data across 15 countries named in «Iran outlook in 2025», over the period 2004-2011. Our aim is to assess whether the economy grows more or less rapidly in areas where the banking sector is more concentrated. The topic is motivated by the fact that the causality between concentration in banking industry and economic growth has not been examined in Iran and the countries named in Iran Outlook 2025. In order to investigate the relationship, the standard Granger causality test and Hsiao’s version of Granger causality test are employed in this paper. The results show that banking concentration is negatively associated with economic growth. Besides, the evidence suggests that economic growth has a positive effect on bank monopoly power.Keywords: Banking Structure, Economic Growth, Countries of Iran's Prospective District

-

Pages 103-113This paper investigates the relationship between total energy consumption and GDP in six countries of the Middle East, including Iran,Pakistan,Saudi Arabia,Oman,Bahrain and the United Arab Emirates. The data are annual and spanning the period 1980-2012.We employed Hsiao’s (1981) methodology to examine causality relation between total energy consumption and GDP.The empirical findings show a unidirectional causality relation between total energy consumption and GDP for Iran running from energy to GDP,and supports the growth hypothesis for Iran. For Saudi Arabia there is a unidirectional causality running from GDP to total energy consumption. Therefore we can accept conservation hypothesis about Saudi Arabia.There is bidirectional causality relation for other countries which support the feedback hypothesis about them.Keywords: energy consumption, GDP, Middle East, Causality relation

-

Survey of Money- Output Causality: Case Study of Iran, Based on Vector Error Correction Model (VECM)Pages 116-132This study investigated the dynamic relationship between money, prices and output in a multivariate structure of casualty analysis in Iran for the two period of 1969 to 2012 (entire period) and 1989 to 2012 (sub-period). This statistical framework has been projected for situations where causal links may have changed over the sample period. Results of a three-variable Vector Error Correction Model (VECM) analysis were indicative for existence of one co-integrated relationship between money supply, price and real output at both periods. Although there was a long run relationship between money, output and prices for both periods, direction of casualty has changed for sub-period. Also error correction terms showed that short run adjustment toward long run equilibrium was faster and stranger at sub-period, when Central Bank of Iran (CBI) adopted expansionary monetary policy and consequently rapid increase in liquidity. Finally money- output causality was not confirmed in this method and presence of correlation (not causality) between variables may just resulted from some other variables in economy as source of changes.Keywords: Monetary Policy, Error Correction Model, Granger Causality, Variance Decomposition, Money, Output Relationship

-

Pages 133-156In this paper, the Cox proportional hazard model is used to answer several questions. In general, fourteen variables are applied in four groups: firm, industry, expenditure human resources specific characteristics as well. According to the previous literature in this field, the findings of this paper also show that the factors which affect life duration of firms are different between industries. Summing up, the life duration of manufacturing firm in Iran are positively affected by start-up size, profitability, efficiency, concentration rate, minimum efficient scale, industry growth rate, investment, advertising and education expenditure as well as labor force skills. While, entry rate of firms affect the life duration of firms, inversely. In term of policy, the findings of this paper confirm the importance of industry on the firm’s life duration and the necessity of paying more attention to this variable.Keywords: Cox Hazard Function, Life Duration, Manufacturing Industries of Iran, New Firms