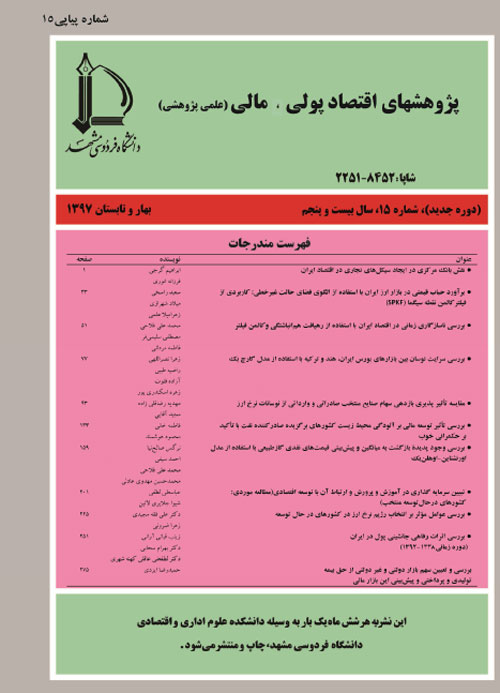

فهرست مطالب

نشریه اقتصاد پولی، مالی

پیاپی 15 (بهار و تابستان 1397)

- تاریخ انتشار: 1397/02/03

- تعداد عناوین: 11

-

-

صفحات 1-32هدف این تحقیق، بررسی نقش بانک مرکزی و سیاستهای پولی در وقوع سیکلهای تجاری در اقتصاد ایران است. تاثیر سیاستهای پولی بر سیکلهای تجاری و اثر سیاست پولی بر پویاییهای آنها، مرحله کلیدی درک نقش بازارهای پولی در اقتصاد است. برای این منظور با استفاده از اطلاعات دوره زمانی1370-1392 با تواتر دادههای فصلی ابتدا با استفاده از فیلترهای اقتصادی به استخراج سیکلهای تولید ناخالص داخلی و نقدینگی پرداخته شد؛ سپس با استفاده از روش خودرگرسیون برداری و ابزارهای تحلیلی آن نشان داده شد که نوسانات نقدینگی نسبت به نوسانات تولید پیشرو است. مساله مهم و محوری تمامی اقتصادهای مدرن و امروزی وجود پدیده سیکلهای تجاری و یا نوسانات اقتصادی است. پیدایش چنین سیکلهای تجاری در بسیاری از موارد باعث بروز مشکلاتی برای اقتصادها گشته و دورانی از شرایط تورمی و یا رکودی ناخواسته را برای آنها به وجود آورده که خود ممکن است منتج به شرایط ناگوار دیگری برای اقتصاد گردد. در نتیجه، به نظر می رسد مطالعه این پدیده، بررسی علل به وجود آمدن آن و چگونگی از بین بردن آن از مهمترین دغدغه های سیاستگذاران اقتصادی هر کشوری به شمار می آید.کلیدواژگان: سیکل تجاری، نقدینگی، سیاست پولی، مدل خودرگرسیون برداری

-

صفحات 33-50به طور کلی، کشف صحیح حبابهای قیمتی داراییها به دلیل نااطمینانی در شناسایی دقیق عوامل بنیادین و تصادفی بودن آنها پیچیده و دشوار است. به ویژه، اگر حبابها ذاتی بوده و به بنیادها وابسته باشند، تصریح صحیح معادله حباب دشوارتر میشود. بسیاری از روشهایی که تاکنون جهت آزمون حبابهای قیمتی به کار گرفته شدهاند، به دلایل مختلفی مورد انتقاد قرار گرفتهاند. در این راستا، مطالعه حاضر با تشکیل یک الگوی فضای حالت غیرخطی از تکنیک فیلتر کالمن نقطه سیگما (SPKF) برای اندازه گیری حبابهای قیمتی در بازار ارز غیررسمی ایران در بازه زمانی 1394:06-1381:01 استفاده کرده است. نتایج نشان میدهد که بخش قابل توجهی از تغییرات نرخ ارز در این دوره زمانی، به خصوص در دهه 1390، به دلیل تشکیل حبابهای قیمتی بوده است. در این چارچوب، بیشترین سهم حباب ها در تغییرات نرخ ارز نیز مربوط به ماه مهر سال 1391 بوده است، به طوریکه حدود 61 درصد از افزایش نرخ ارز در این ماه در مقایسه با ماه قبل به حباب قیمتی نسبت داده شده است. به علاوه، در سال 1394، حبابهای نرخ ارز بسیار ناچیز و ارزش بازاری نرخ ارز نزدیک به ارزش بنیادی آن بوده است.کلیدواژگان: حبابهای قیمتی، مدل فضای حالت غیرخطی، فیلتر کالمن نقطه سیگما (SPKF)، بازار ارز، ایران

-

صفحات 51-75بر اساس مفهوم ناسازگاری زمانی، اگر در فاصله زمانی و ترجیحات یا فن¬آوری تغییر نکرده و شوک پیش¬بینی نشده¬ای نیز روی ندهد، به نظر می¬رسد سیاست اتخاذ شده در زمان حال برای آینده، -باید در موعد مقرر نیز از همان درجه اعتبار برخوردار باشد؛ اما گاهی بنابر مصلحت¬اندیشی مقامات اجرایی این مهم به دست نمی¬آید. اگر این اقدام سیاست¬گذاران غافل¬گیرکننده باشد، این امکان وجود دارد که موقعیتی بهتر از آنچه وعده داده شده، حاصل شود. اما اگر این سیاست پیش¬بینی شود، بدون تغییر نرخ بیکاری، تورم بالاتری پدید می¬آید. در این تحقیق، وجود مساله ناسازگاری زمانی در اقتصاد ایران در دو دوره بلندمدت و کوتاه¬مدت با استفاده از الگوی Ireland (1999) بررسی می¬شود. در رابطه با دوره بلندمدت، هم¬انباشتگی میان متغیرهای فصلی بیکاری و تورم برای دوره¬ زمانی 1369:2 تا 1394:2 و 1381:1 تا 1394:2 آزمون شده و برای کوتاه¬مدت و در توضیح پویایی و حرکت همزمان تورم و بیکاری با در نظر گرفتن شوک¬های غیرقابل مشاهده، معادلات فضا حالت و رهیافت کالمن فیلتر مورد استفاده قرار می¬گیرد. نتایج بدست آمده نشان دهنده وجود مساله ناسازگاری زمانی در هر دو دوره کوتاه¬مدت و بلندمدت در اقتصاد ایران است و در نتیجه، اقتصاد نه تنها به سطح بیکاری پایین¬تر نمی¬رسد، بلکه در همان سطح اشتغال، تورمی بالاتر را تجربه می¬کند.کلیدواژگان: ناسازگاری زمانی، تورم، بیکاری، کالمن فیلتر، فضا، حالت

-

صفحات 77-91

بین المللی شدن بازارهای مالی، باعث شده است آنچه در یک کشور روی می دهد به سرعت در کشورهای دیگر احساس شود. این امر بازده و ریسک اوراق بهادار موجود در بورس را تحت تاثیر قرارداده، بنابراین لازم است میزان ارتباط بین بازارهای بورس به خوبی مورد شناسایی و تحلیل قرار گیرد. به این منظور در مقاله حاضر دو هدف دنبال می شود: 1) بررسی تاثیر بازارهای بورس هند و ترکیه بر بازار بورس ایران؛ 2) بررسی اثر بازار بورس ایران بر بورسهای هند و ترکیه. در این راستا این ارتباط به صورت جفت جفت بین بازار بورس ایران و بازارهای بورس ترکیه و هند موردبررسی قرار می گیرد. در این تحقیق که تمرکز اصلی آن بر مدل سازی نوسان در بازار بورس ایران و دو بازار بورس کشورهای آسیایی است، یک مدل گارچ چند متغیره توسعه داده شده که با استفاده از آن به بررسی سرایت نوسان بین شاخص های قیمت بازار بورس ایران، بازار بورس ترکیه و بازار بورس هند پرداخته شده است. رابطه بین بازارهای سهام، ایران، ترکیه و هند با استفاده از داده های روزانه قیمت سهام در دوره (2007-2013) و مدل گارچ بک (Angel & Keroni, 1995) موردبررسی قرار گرفته است. نتایج نمایانگر ارتباط مستقیم از بازارهای خودی با یک دوره قبل پسماند خود در هر سه کشور است. در مورد بازارهای خودی ضرایب آرچ و گارچ در مورد هر سه کشور ایران، هند و ترکیه معنادار هستند؛ بدین معنی که نوسان شاخص بازار بورس سه کشور ایران، هند و ترکیه با نوسان های قبلی خود ارتباط معنی دار آماری دارد؛ اما در مورد ارتباط بازار ایران با بازارهای هند و ترکیه هیچ اثری یافت نشد؛ به عبارت دیگر هیچ گونه سرایت نوسان از شاخص بازار بورس ایران به ترکیه همچنین در جهت مخالف، یعنی از بازار ترکیه به ایران وجود ندارد. در مورد بازار بورس هند نیز همین نتایج حاصل شد.

کلیدواژگان: بازار مالی، نوسان، مدل گارچ بک -

صفحات 93-131با توجه به این که کشور ایران طی سال های اخیر با نوسانات عمده ای در نرخ ارز مواجه بوده و این نوسانات نیز دارای نقش اساسی در تعیین میزان بازدهی صنایع صادراتی و وارداتی کشور هستند، در این مطالعه با استفاده از نظریات اقتصادی و با تکیه بر مدل تصحیح خطای پانل (PECM) و آزمون های هم انباشتگی و علیت پانل ، رابطه کوتاه مدت و بلند مدت بین نرخ ارز و بازدهی سهام صنایع عمده صادراتی و وارداتی فعال در بورس اوراق بهادار تهران با استفاده از داده های ماهیانه طی دوره زمانی 94-1384 مورد آزمون و بررسی قرار گرفته است و به صورت کمی برآورد خواهد گردید. برآورد ضرایب بلندمدت در این مطالعه با استفاده از روش حداقل مربعات معمولی پویا (DOLS) و برآورد ضرایب کوتاه مدت و روابط علیت با استفاده از روش گروه میانگین ادغام شده (PMG) انجام می گیرد. نتایج به دست آمده بیانگر این است که یک رابطه تعادلی بلندمدت بین متغیر نرخ ارز و سایر متغیرهای موثر بر بازده سهام - شامل بازده مازاد بازار، قیمت نفت خام، نرخ تورم و نرخ بهره- با بازدهی سهام صنایع مورد مطالعه طی دوره مورد بررسی وجود دارد. یافته ها در گروه صنایع صادرکننده نشان می دهد که نرخ ارز تاثیر مثبتی بر بازده سهام داشته و یک رابطه دو طرفه بین این دو متغیر وجود دارد؛ در حالی که یافته های معادلات برآورد شده در گروه صنایع وارد کننده نشان دهنده یک رابطه دوطرفه منفی بین نرخ ارز و بازده سهام صنایع مذکور است.کلیدواژگان: مدل تصحیح خطای پانل، هم انباشتگی پانل، نرخ ارز، بازده سهام، صنایع صادراتی، صنایع وارداتی Issue Info

-

صفحات 133-158برخی معتقدند توسعه مالی باعث کاهش آلاینده¬های محیطی می¬شود، اما برخی دیگر اعتقاد دارند توسعه مالی انتشار گازهای گلخانه¬ای را از طریق رشد صنعتی افزایش می¬دهد. مطالعه حاضر به بررسی اثر توسعه مالی بر آلودگی محیط زیست در 16 کشور برگزیده صادرکننده نفت طی دوره 2014-1996 با استفاده از روش داده¬های تابلویی می¬پردازد که علاوه بر این فاکتور، اثر حکمرانی خوب روی آلودگی محیط زیست نیز مورد بررسی قرار می¬گیرد. با توجه به منابع زیست محیطی، حکمرانی خوب را می¬توان به این صورت تعریف نمود: شیوه¬ای از مدیریت تصمیم گیری¬ها، به سمت ترویج توسعه پایدار (که شامل حفاظت از محیط زیست می¬باشد). نتایج مطالعه حاضر نشان می¬دهد توسعه مالی و حکمرانی خوب اثر منفی روی آلودگی محیط زیست در کشورهای برگزیده صادرکننده نفت دارد. بنابراین اتخاذ سیاست¬های مناسب جهت توسعه بخش مالی و کاهش آلودگی محیط زیست پیشنهاد می¬گردد.کلیدواژگان: توسعه مالی، آلودگی محیط زیست، حکمرانی خوب، کشورهای برگزیده صادرکننده نفت، داده های تابلویی

-

صفحات 159-200

هدف از این مقاله، اثبات وجود پدیده بازگشت به میانگین، برآورد مدل بازگشت به میانگین اورنشتاین-اوهلن¬بک (OUMRM) و پیش بینی قیمت های نقدی گاز طبیعی بر اساس داده¬های هنری هاب در دوره زمانی 07/01/1997 تا 20/03/2012 است. استفاده از انواع آزمون¬های بازگشت به میانگین مانند ریشه واحد، ضرایب خودهمبستگی و… نشان می دهند که سری بازده مورد بررسی از یک فرآیند گام تصادفی پیروی نمی کند. همچنین مقدار میانگین بلندمدت تعادلی قیمت برابر با 16/4 دلار بر هر میلیون بی تی یو بوده و به طور متوسط 48 هفته طول می کشد تا شوک های وارد شده بر قیمت های نقدی گاز رفع شود. به دلیل شفافیت و سیالیت بیشتر اطلاعات و نیز وجود رقابت بیشتر در بازارهای گاز در سال های اخیر هر چه به دوره های اخیر تر رجوع شود سرعت بازگشت به میانگین بیشتر شده که بیانگر رفع سریع¬تر انحرافات ناشی از شوک های وارد شده به بازار بوده و مقدار بالاتر میانگین تعادلی بلندمدت در دوره-های اخیر نشان دهنده آن است که سرمایه گذاران و مبادله گران انتظار انتقال رو به بالای قیمت های گاز در بازار را دارند و تلاطم قیمت در قیمت های بالاتر از میانگین بیشتر از قیمت های پایین تر از میانگین است. در نهایت، مقادیر معیارهای ارزیابی عملکرد و مقایسه آن ها برای تعداد اجراهای مختلف تصادفی نشان می¬دهد که نتایج مربوط به میانگین 1000 اجرا دارای بهترین مقادیر است.

کلیدواژگان: : گاز طبیعی، قیمت نقدی، بازگشت به میانگین، مدل اورنشتاین-اوهلن بک -

صفحات 201-223در این مطالعه به بررسی نقش آموزش وپرورش بر رشد اقتصادی کشورهای در¬حال¬توسعه منتخب (ایران، بلغارستان، پرو، رومانی، تایلند، ترکیه، تونس، مالزی، آرژانتین، برزیل، شیلی، مکزیک) با استفاده از داده¬های تلفیقی (پانل دیتا) طی دوره 2005-2015 پرداخته شده است. نتایج مطالعه بیانگر اثر مثبت و معنی¬دار سرمایه گذاری در آموزش وپرورش بر رشد اقتصادی کشورهای درحال¬توسعه منتخب است. همچنین پایین بودن هزینه¬های آموزشی و درنتیجه نادیده گرفتن تاثیر آموزش و تربیت نیروی انسانی ماهر، از مهم ترین عوامل پایین بودن سطح رشد اقتصادی در کشورهای درحال توسعه است؛ بنابراین شایسته است که با توجه به جمعیت روزافزون جوان در کشورهای درحال¬توسعه از یک سو و نیاز مبرم این کشورها به رشد و افزایش تولید از سوی دیگر، توجه جدی به ارتقای سطح و کیفیت آموزش از طریق افزایش هزینه¬های آموزشی صورت گیرد.کلیدواژگان: سرمایه گذاری در آموزش و پرورش، سرمایه انسانی، رشد اقتصادی، کشورهای درحال توسعه

-

صفحات 225-249انتخاب نظام ارزی از طریق اثرگذاری بر بسیاری از متغیرهای اقتصادی می تواند نقش بسزایی در شرایط موجود و آینده اقتصاد هر کشوری ایفا نماید. همچنین، انتخاب رژیم نرخ ارز نقش اساسی در سیاست های کلان اقتصادی در کشورهای درحال توسعه دارد. در این مطالعه به بررسی عوامل اقتصادی و سیاسی موثر بر انتخاب رژیم¬های ارزی در کشورهای در حال توسعه با درآمد بالاتر و پایین تر از میانگین در دوره زمانی 2014-1990 با استفاده از روش لاجیت و پروبیت پرداخته شده است. به طورکلی نظریه¬های رایج در انتخاب نظام ارزی نظریه انتخاب منطقه بهینه ارزی OAC، نظریه اقتصاد سیاسی و فرضیه بحران ارزی هستند که در این پژوهش بر تئوری OCA و اقتصادی سیاسی تاکید شده است. نتایج پژوهش بیانگر این است که عوامل OCA بر انتخاب رژیم¬های نرخ ارز در کشورهای در حال توسعه تاثیر¬گذار هستند. متغیرهای اندازه اقتصاد، تورم و توسعه مالی احتمال انتخاب رژیم نرخ ارز شناور را افزایش می دهد و متغیرهای توسعه اقتصادی، میزان باز بودن تجاری و شوک های پولی احتمال انتخاب آن را کاهش می دهند. به طورکلی می توان گفت که متغیر توسعه اقتصادی در هر دو گروه از کشورهای در حال توسعه بیشترین اثر را در انتخاب نرخ ارز ثابت دارد و تجارت خارجی در کشورهای در حال توسعه با درآمد پایین تر از میانگین و شوک پولی در کشورهای در حال توسعه با درآمد بالاترین از میانگین، کمترین اثر را در انتخاب نرخ ارز ثابت داشته اند.کلیدواژگان: رژیم نرخ ارز، کشورهای در حال توسعه، تئوری OCA، لاجیت

-

صفحات 251-274جانشینی پول پدیده رایج کشورهای درحال توسعه است که اثرات متفاوتی بر رفاه اقتصادی افراد جامعه دارد. یکی از معیارهای مهم بررسی رفاه اقتصادی افراد جامعه، مصرف خصوصی می¬باشد. این پژوهش به بررسی اثرات رفاهی جانشینی پول از طریق تاثیر درجه جانشینی پول بر مصرف خصوصی می¬پردازد. در این پژوهش ابتدا از روش کمین و اریکسون (2003) برای برآورد حجم پول خارجی درگردش و درجه جانشینی پول استفاده می¬شود. برای تخمین تابع تقاضای پول واقعی در روش کمین و اریکسون و همچنین برای بررسی تاثیردرجه جانشینی پول بر مصرف خصوصی از روش هم جمعی جوهانسون-جوسیلیوس استفاده می¬شود. نتایج روش هم¬انباشتگی جوهانسون-جوسیلیوس نشان داد که تاثیر جانشینی پول بر مصرف خصوصی منفی و معنی¬دار است. به عبارتی دیگر با افزایش درجه جانشینی پول، مصرف خصوصی افراد کاهش می یابد و درنتیجه رفاه اقتصادی افراد نیز کاهش می یابد.کلیدواژگان: جانشینی پول، رفاه، مصرف خصوصی، هم انباشتگی جوهانسون-جوسیلیوس، ایران

-

صفحات 275-295صنعت بیمه به عنوان یک موسسه مالی غیر بانکی با ارائه خدمات و برقراری ارتباط منطقی بیشتر با سایر بخش¬های صنعتی، تولیدی، کشاورزی و خدماتی از راه گردآوری حق بیمه¬های اندک بیمه¬گذاران، گروهای مختلف اقتصادی و پرداخت به موقع خسارت می¬تواند ضمن ایجاد و تامین سرمایه¬های خصوصی و عمومی، با برقراری آسایش و امنیت خاطر نزد کارآفرینان، صاحبان حرفه، مشاغل جامعه در افزایش تولید، کاهش واردات از بازارهای جهانی و قطع وابستگی نقش موثری در توسعه اقتصادی ایفا نماید. شناسایی و بررسی بازار بیمه از نظر نقش سهم دولتی و غیر دولتی به سبب سرمایه¬گذاری در آن بازار، می تواند اثر قابل توجهی بر ذخیره منابع مالی داشته باشد. ازاین رو پیش¬بینی این بازار در تولید، پرداخت حق بیمه، کنترل و هدایت این منابع مالی به بخش¬های اقتصادی جهت سرمایه¬گذاری، طرح و اعمال سیاست¬های پولی و مالی جهت رسیدن به اهداف بلندمدت اقتصادی موثر است. نتایج حاکی از آن است که صنعت بیمه با جذب حق بیمه¬های دریافتی و به جریان انداختن منابع پولی جمع آوری شده به صورت کارا و با سرمایه¬گذاری این منابع، می¬تواند بستر مناسبی برای رشد و توسعه اقتصادی فراهم آورد.کلیدواژگان: حق بیمه تولیدی و پرداختی، سهم دولتی و غیر دولتی، پیش بینی

-

Pages 1-32This paper investigates the role of the central bank and monetary policy in the occurrence of the business cycles in Iran’s economy. This is important since the effects of monetary policy on the business cycle and its dynamics are the main stage in understanding the role of financial markets in the economy. Therefore, in this study, using the quarterly data from, 1999-2013 the cycles in GDP and liquidity have been elicited (with the help of economic filters); then, using vector autoregressive model, it is shown that fluctuations in liquidity are leading the fluctuations in production.

The most important and crucial issue among modern economics is the existence of commercial cycles or economic fluctuations. The emergence of such business cycles, which in many cases caused problems for the economies and created a period of unintentional inflationary or recessionary events which could itself lead to other adverse economic conditions. Consequently, it seems the study of this phenomenon and the causes of its creation as well as finding options to deplete those problems are the most concerning issues of economic policies in every country. Commercial cycles are fluctuations which are defined in terms of frequency periods of boom and recession. Economic activities usually consist of two stages, recession and boom. When production and employment decrease and lead to poverty, they reduce the welfare and lower the living level of people; hence, it means that economic activities are in recession. Additionally, when production and employment rise, it brings about welfare and increases society’s living quality; this means economic is about to get better or boom. Although, these cycles occur frequently, none of two cycles are similar to each other. During later decades recognition of causes, predictions and economic fluctuations are the most important issues of macroeconomic and policy making economists. Among commercial cycles, usually parameters like production, employment, real income and real sale level decrease and increase together. On the other hand, some economic parameters before empowering a cycle are considered as pioneer indices, which indicate the existence of an economic cycle in future. Among these parameters, we can name those that are cooperating in changing of money, credits, crucial prices, order volume in production parts, personal contracts, number of started buildings and number of working hours. It can be said that, a group of economists believe that economics essentially has a problem which for some reasons will lead to commercial cycles. On the other hand, another group of them believe that some external intruding will lead to the creation or at least increase of these cycles. According to the second group, economics essentially has stability and since the external intruding of government, banks, and other sources do not exist, economics will not experience any commercial cycle, and as a result, the essential and crucial question is whether it is possible to get rid of the cycles.

Generally, we can study the reasons of growths in real volume of country’s economic activities in two aspects of changes in demand and supply. The considerable point is that, the existence of stability in a country’s economy could be useful in various aspects and essentially one of the duties of governments and planning systems is providing economic stability. Thus, with the recognition of fluctuation’s structure and cycles in economy, we should try to control and decrease the intensity of them. Severe economic fluctuations or cycles are natural, and instability growths in economy, households, and economic firms cannot make a bright prediction of future. In times of recession or moving towards a recession, unemployment has increased and production has declined, and some production units may even be out of business and prices are falling. What is important is to know what initially creates prosperity and then, after a period of economic activity, it will lead to slowdowns and stagnation. In other word, it seems that in economic cycles we must look for the reasons of appearance, duration, and power of these fluctuations. There are various theories and reasons which lead to commercial cycles in macroeconomic literatures. Some of these theories say that the origin of fluctuations and commercial cycles is in policies of the demand side. The theory of Keynesians, the monetary (Chicago School), and the theory of rational expectations and its subcategories, including the new classics (monetary branches) and the new Keynesians, are among these theories.

According to some theories, commercial cycles are related to supply spectrum theory. One of these is the Real Commercial Cycle Theory (RBC), which argues that fluctuations and business cycles are explained by the volatility of real variables in the economy . Whether the central bank can pursue active economic stabilization policies and, on the other hand, whether anti-cyclical monetary policies can be effective in controlling business cycles is a great help for economic policy-makers and policy makers. The answer to these questions will be very helpful to economic regulators and central banks’ policy makers. Consequently, it seems that the recognition and understanding of commercial cycles will be the first step in retrieving the role of central bank, and as a result, they will be considered in designing stability policies.

Based on the obtained results, on average, 23 periods are observed, with peak periods, the rate of liquidity change was about 9 months (6 months) from the peak of the level of economic activity.Results and discussionVariance Dissection (VD)

The results of the dissection of variance in Table 10 show that in the short term (about three cycles ), the explanatory power of the growth of government expenditures from periods of stagnation and boom is higher than the explanatory power of liquidity growth, but, in the medium and long term, liquidity growth has a greater potential for expanding business cycles and periods of recession.ConclusionIn this paper, we tried to answer the above question using a theoretical explanation and designing a self-regression vector (VAR) model in order to analyze the experimental effect of this relationship. Based on the results, it is found that, on average, using 23 cycles, the peak of interest rates was about 9 months away from the peak of economic activity. This could indicate that fluctuations and changes in the rate of liquidity growth as an indicator for monetary policy in the Iranian economy are one of the factors that trigger business cycles in Iran's economy. To evaluate the dynamics among the model variables, the action-response functions were used. The results reflect the negative reaction of the business cycle to inflation. In other words, the inflation rate has a positive and significant effect on the duration of the recession, so by increasing it by one percent, the length of the recession or the risk of withdrawal from this period will be reduced. Therefore, with rising inflation, the length of the recession in Iran will increaseKeywords: Business cycle, liquidity, monetary policy, vector autoregressive model VAR -

Pages 33-50The asset price bubble is the deviation of the asset price from its fundamental value. The price bubbles usually have common features. On one hand, providing excessive loans and facilities along with continuous raises in demand and asset price cause an inflation in price bubbles. On the other hand, the bubbles burst and the asset prices collapse because of abundant sales. Since many of the financial crisis arise from bursting bubbles of financial assets, exploring the bubbles behavior in these markets and the early detection for the prevention of adverse economic consequences is important.

Generally, the correct detection of assets price bubbles is complex and difficult due to uncertainty in accurate identification of the fundamental factors and their randomness. Especially, if the bubbles were inherent and dependent on fundamentals, the correct specification of the bubble equation will be more difficult. Many of the methods used for testing the price bubbles, have been criticized for various reasons. In this line, the present study has used Sigma-Point Kalman Filter (SPKF) to measure the price bubbles in the non-official foreign exchange market of Iran during the period of 2002:04-2015:09, forming a nonlinear state space model.MethodologyIn this paper, to derive the state-space model, the presented value model with variable discount rates was used as a start point. After solving this equation, the asset price includes two components, the fundamental value and the non-fundamental value or the speculative bubble. By applying the transversality condition, we obtain no bubble solution. The fundamental value is affected by market fundamentals and is expressed as the sum of the asset’s expected future dividends discounted to the present time. But, if the transversality condition be violated, this equation is the only solution for main equation.

The price bubble can be a function of fundamental factors. In addition, the relationship between the expected bubble and the current bubble values follow a nonlinear process.

If prices and fundamentals have unit root, we can write the general solution in differences. Since the bubble is an unobservable component, we regard it as a state vector and estimate it in a state space model. In addition, because fundamentals and price are observable, we consider them as observation vectors in signal equation. We assume the fundamentals follow an ARIMA (h, 1, 0) process, where h is determined empirically.

In the present study, we apply the Sigma Point Kalman filter (SPKF) for foreign exchange market in Iran. In this regard, we have taken consumer price index and real interest rate as fundamentals in nonofficial exchange rate of Iran. After specifying the state space model, this model is estimated using the maximum likelihood method. Then, we extract the bubble component using SPKF algorithm and by the MATLAB software.Results and DiscussionIn order to identify the series of foreign exchange market bubbles, we have followed the SPKF methodology to detach the bubble component from the fundamental component in exchange rate. Since price variables are nonstationary in level, but stationary in first difference, we are capable of separating the bubble component of a change in the exchange rate from its fundamental components.

Regarding SPKF model estimation for the period of 2002:04 to 2015:09, most of the bubbles in exchange rate changes have been compressed at the 2012m09 so that about 61 percent of the exchange rate change can be attributed to the bubble component. Moreover, it can be seen that the non-official exchange rate of Iran in the 2000s had a very mild rising trend and slight volatilities. However, in the 2010s, at the same time with the intensification of economic sanctions, the decline in foreign exchange earnings and the rise in inflation, the exchange rate has experienced a significant growth.ConclusionIn this paper, we applied a Sigma-Point Kalman filter (SPKF) to extract the bubble term from exchange rate changes in non-official market of Iran during 2002:04-2015:09.The results showed that the significant part of the exchange rate changes, especially during 2010s, have been due to the formation of price bubbles. In this framework, the highest share of bubbles in exchange rate changes has been related to 2012:10 so that about 61 percent of the increase in exchange rate in this month compared to the previous month have been attributed to price bubbles. Moreover, in 2015, the exchange rate bubbles have been very insignificant and the market value of the exchange rate has been close to its fundamental valueKeywords: Price Bubbles, Nonlinear State Space, Sigma-Point Kalman Filter, Foreign Exchange, Iran -

Pages 51-75IntroductionOne of the advantages of Friedman’s theory for committing to a monetary policy is that firms, workers and consumers would be able to form their expectations about the future policies implemented by the central bank and monetary authorities. The intuition of the time inconsistency concept, introduced by Kydland and Prescott (1977) who won the Nobel Prize in Economics, is about a situation in which “being optimal in past” is different from “being optimal in future”. This problem arises, because the preferences of individuals would change during the time of making decisions until the time of implementing the chosen policy. If private sector knows and believes that the central bank is committed to a certain inflation target, then, the economic performance will improve by lower inflation expectation and lower inflation rate at a given rate of unemployment. But sometimes when the announced policy is believed by private sector, the authorities get incentives to change the policy in order to lower unemployment by making an unexpected inflation. Therefore, the unemployment would be lower than natural rate and the production level would rise more than full employment level.

In this study, the existence of time inconsistency in Iran’s economy is examined in both the long-run and short-run terms based on Ireland model (1999). For the long-run, the existence of cointegration between quarterly variables of inflation and unemployment time series is tested for 1990:5 to 2015:5 and 2002:4 through 2015:5 in short-run in order to explain the dynamics and co-movement of inflation and unemployment including unobserved shocks, state space equations and Kalman filter approach are used.

Theoretical Framework

Time inconsistency concept can help to understand the incentives of policymakers to change a policy during time. If policymakers can surprise the private sector, they will attain their goals at a lower cost. But, due to rational expectations, the incentives according to time inconsistent behavior can lead to an inflationary orientation in monetary policy. The inflationary bias as described by Kydland and Prescott (1977) comes from the inability of monetary authority to commit to a low-inflation policy.MethodologyIn this study the Ireland (1999) model is applied, which is based on Barro-Gordon’s model (1983). Barro-Gordon model explains the behavior of unemployment rate based on Philips Curve and introduces an objective function for the central bank with two variables, namely, inflation and unemployment rate.

Ireland describes a more general autoregressive process for unemployment rate which contains a unit root and presents a control error term for inflation. As a result, Ireland explores long-run and short-run relationships between these two variables. If both variables have a unit root, then, one can examine the cointegration relationship between them which is confirming the existence of time inconsistency problem in the economy for the long-run term. For the short-run relationship, state-space model and Kalman filter approach are used. This study examines both terms in Iran’s economy for two quarterly times series variables 1990:5 to 2015:5 and 2002:4 to 2015:5.Results and DiscussionFor the first part, testing the cointegration constraint, Augmented Dickey-Fuller test is applied to check for the unit roots in the two series. The results show the process for unemployment contains a unit root in either sample period. The Johansen test and the likelihood ratio statistic are used to test the null hypothesis of no cointegration. The result of Johansen test rejects the null hypothesis of no cointegration between inflation and unemployment at the 0.01 significance level for the full sample and at the 0.1 significance level for the post-2002 sample. Thus, as predicted by the model, the two variables are cointegrated.

To understand the theory's implications for the short-run behavior of inflation and unemployment, the maximum likelihood estimates of the model's parameters are obtained by mapping the constrained ARMA model into the state-space form and using the Kalman filter to evaluate the likelihood function, as suggested by Hamilton (1994). At 0.01 critical value for a chi-square random variable with 10 degrees of freedom, based on model’s structure, the likelihood ratio tests do not reject the model's short-run restrictions.

Conclusions and Suggestions

Does the time-consistency problem explain the behavior of inflation in Iran? Barro and Gordon's (1983) model of time-consistent monetary policy implies that long-run trend in the natural rate of unemployment will introduce similar trend into the inflation rate when the central bank cannot commit to a monetary policy rule. Tests of the model's short-run restrictions, indicate that the model is also successful at accounting for the dynamic, quarter-to-quarter co-movement of inflation and unemployment in Iran.

The results can potentially explain the persistent inflation in Iran’s economy. In other words, in Iran’s economy which the policymaker’s decision often related to short-run term and their decisions are variable and unstable, the consideration of the outcomes of time inconsistency behavior could be useful. However, because of the major role of oil income in the economy, there are a lot of unexpected shocks which can limit the government to commit to a rule. Thus, considering not an optimal amount but an optimal range of discretionary behavior would be desirable.Keywords: Time Inconsistency, Inflation, Unemployment, Kalman Filter, State-Space Model -

Pages 77-91Introduction

Internationalization of financial markets has caused what is happening in a country to be felt quickly in other countries. This affects the returns and risks of securities listed in the stock exchange; therefore, it is necessary to identify and analyze the relationship between stock markets properly. For this purpose, two goals are pursued in this paper; investigating the impact of the Indian and Turkish stock markets on the Iranian stock market, and investigating the effect of the Iranian stock market on the stock markets of India and Turkey. Theoretical Framework

The past decade has experienced financial and economic crises affecting economic development and evaluation principles. Due to the turbulence of the crisis, financial analysts and market participants feared that the overflow of the crisis into other economies might boost instability in global financial markets. Experience has shown that the effects and the extent of the spread of crises vary in scope and quality. For example, the financial turmoil in the Turkish stock market in 2001 was completely independent and had no impact on other markets (Desai, 2003), while Mexican and Asian crises had regional implications (Glyctic & Rose, 1999). In contrast, the Russian financial crisis of 1998 increased the volatility of global security of markets with enormous adventures (International Settlement Bank, 1999).

Today, financial markets are moving towards integration more than before, and countries have close economic relations in addition to their cultural and political ties. This is in many respects positive, but it also brings about many changes in the financial and economic system of countries (Ahmadzadeh, Heydari & Zolfaghari, 2012).

According to experts, since the recession in the United States and European countries, which led to bank failures and subsequent downsizing in the economy of these countries, the demand for energy and oil will reduce world oil prices. Some countries (e.g., oil-dependent economies) will face with lots of problems. At the outset of the crisis, it was a misconception that Iran would not take any effect from this crisis and could even be an ideal opportunity for the Iranian economy, but over time, the effects of the crisis put new challenges to the Iranian economy including a dramatic drop in oil revenues, a recession in the global market, decrease in non-oil exports, and consequently, drop of Tehran’s stock market.

The purpose of this paper is to examine whether fluctuations in the stock market of countries with which Iran has a good economic relationship is transferred to the stock market of Iran. For this purpose, two goals are pursued in this paper; investigating the impact of the Indian and Turkish stock markets on the Iranian stock market, and investigating the effect of the Iranian stock market on the stock markets of India and Turkey.MethodologyIn this regard, this relationship is examined as Couples between the stock market of Iran and stock markets of Turkey and India. In this research, which focuses on the fluctuation modeling in the stock market of Iran and two Asian stock markets, a multivariate GARCH model has been developed which is used to examine the transmission of fluctuations between price indices of Iranian stock market, the Turkish stock market and the Indian stock market. The relationship between stock markets of Iran, Turkey and India has been evaluated using daily stock price data for the period 2007-2013 and the BEKK-GARCH model (Angel & Keroni, 1995).

Results and DiscussionThe results show that the domestic markets with one-period lagged residual have a direct effect on all three countries. Regarding the domestic markets, the coefficients of ARCH and GARCH are significant for all three countries. This means that the fluctuations of the stock market index of the three countries of Iran, India and Turkey have a statistically significant relationship with previous fluctuations; however, no relationship between the Iranian stock market and the stock markets of India and Turkey was found. In other words, there is no apparent fluctuation transmission from the stock market index of Iran to Turkey, and vice versa. With respect to the Indian Stock exchange, the same results were achieved.

Although the international transfer of stock market volatility may affect the decisions made by the firm's capital budget, investors' consumption decisions, and other business cycles, under such circumstances, it may be argued that because of the insignificant relationship between the Iranian financial market and the global markets, the possibility of a crisis spreading from the Iranian economy to world markets is not possible, but there is still concern about the impact of the global economic crisis on the Iranian economy. Perhaps, its direct effect is to reduce global demand for crude oil, which will increase the pace of the global crisis in the Iranian economy, given the strong dependence of Iran's economic budget on oil revenues.Keywords: Financial market, volatility, BEKK-GARCH model -

Pages 93-131IntroductionIran has faced with high fluctuations in exchange rates in recent years and this volatility plays an important role in determining the return of exporter and importer industries in Iran. Thus, this study will estimate the relationship between exchange rate and return of exporter and importer industries in Tehran stock exchange. In addition, world oil price, excess market return, inflation rate and interest rate, which are the most important variables affecting the stock return, will be introduced as explanatory variables.

Theoretical framework

Exchange rate is a very important factor in a country’s economy and in the Stock market. An increase in the exchange rate leads to more expensive imports for domestic industries and increases their production costs. This has a negative effect on industries’ profit and their dividends and thus decreases their stock return. On the other hand, an increase in the exchange rate leads to more export and also improves the competition position of domestic producers and thus has a positive effect on the stock returns. The relationship between foreign currency and stock can also be investigated from another point of view; foreign currencies (especially the U.S. dollar) are an alternative asset for stock in countries. Hence, an increase in the exchange rate may increase the demand for foreign currency and shift some part of investor’s money from the stock market to the exchange market, leading to a decrease in the stock return.

We estimate the relationship between exchange rate, world oil price, excessive market return, inflation rate and interest rate, and return of exporter and importer industries in Tehran stock exchange for two groups of industries. We consider four major export industries (ie.e, metal ores mining; cement, lime and plaster; basic metal; and chemicals and by-products) and the four major import industries (i.e., motor vehicles and auto parts; pharmaceuticals; machinery and equipment; and non-metallic mineral products) in Iran, respectively. These industries are closely related to international markets and all of their transactions are conducted by international currency and thus any fluctuations in exchange rate will affect their stock return. Considering the importance of these two groups in Iran’s economy, we estimate the relationship between their stock returns and mentioned variables to analyze how these variables, particularly exchange rate, affect export and import industries in Iran.MethodologyThe long run and short run relationship between exchange rate and return of exporter and importer industries in Tehran stock exchange will be estimated using economic theory, and Panel Error Correction Model (PECM), panel cointegration and causality tests during 2005-2016. Long run and short run coefficients estimations have been done using Dynamic Ordinary Least Square (DOLS) and Pooled Mean Group (PMG) respectively.ConclusionThe results indicate that there is a long-run equilibrium relationship between exchange rate, excessive market return (premium), real crude oil price, inflation rate and interest rate with stock return. The relationship between exchange rate and stock return of exporter industries is positive and there is a bidirectional relationship between these variables. This relationship in importer group is negativeKeywords: panel Error Correction Model, Panel Co integration, Exchange Rate, Stock Return, Exporter Industries, Importer Industries -

Pages 133-158In recent years, global warming has increased with greenhouse gases such as methane, carbon dioxide, water vapor and nitrogen oxide, causing unhealthy changes in the environment. In this regard, this paper consists of five sections. After the introduction in the second part, we describe the studies carried out on the subject of the research. Then, in the third part, the topic is discussed. In the fourth section, the model used and the variables of the model have been introduced and the results of the estimation of the model have been presented. In the fifth part, we have also discussed the conclusion. Empirical studies on the topic of research have been divided into two categories (external studies and internal studies). In each of these divisions, the studies that have examined the impact of financial development on environmental pollution, as well as studies that have examined the role of governance on environmental pollution are mentioned. Since the study of the effect of financial development on the environment has recently been considered, this section is part of a series of studies that refer to the relationship between financial development and the environment, and also based on the few studies that link the financial and environmental development have analyzed the different channels of the impact of financial development on the environment. Since this study is an inter-country study, data panel information in the studied country group (selected countries of the oil exporter) was used during the period 1996-1996. Also, the 16 selected oil exporting countries include Algeria, Bahrain, Ecuador, Egypt, Iran, Jordan, Kuwait, Libya, Nigeria, Oman, Qatar, Saudi Arabia, Syria, UAE, Venezuela and Yemen. Before presenting the results of model estimation, descriptive statistics of the variables used in the model (carbon dioxide emissions, per capita income, per capita energy consumption, good governance index, financial development index) have been presented. The innovation of the present study can be argued that this study, taking into account simultaneously two important variables and the effect of financial and governance development on the environment in one of the models with comprehensive and low probability of error (data panel), and also, by choosing the appropriate country group (which has a very high degree of homogeneity according to the subject matter), it has tried to speak with greater confidence about the effect of financial development on the environment. Based on the estimates of the present research, the coefficients related to economic growth, energy consumption with a positive sign, suggest that there is a direct relationship between these variables and environmental pollution. In other words, economic growth in these countries has been accompanied by further environmental degradation, and excessive consumption of energy in the economic growth process has caused more environmental damage. Now, if economic growth is accompanied by financial development, it can be argued that financial development in the long run will lead to technological advancement, resulting in less energy consumption and less pollution. On the other hand, the coefficient of good governance is negative, indicating that good governance is one of the factors that improve the quality of the environment. Improving the governance index reduces the gap between the people and the state in environmental issues and reduces environmental pollution. In order to develop financial market and reduce environmental pollution it is recommended:Adoption of appropriate policies for the development of the financial sector and reduction of environmental pollution

Provision of resources for the implementation of environmental protection projects, which are often run by the government and other social and economic institutions and require financing.

Due to the lack of capital in low-quality institutions, the reform of financial and institutional infrastructure in order to attract and inflate capital (by regulating environmental regulations and prioritizing more environmentally friendly technologies) is recommended to these countries so that they improve through the level of financial development.

Policy makers should note that financial sector reforms must be implemented step by step with great care in order to prevent financial instability and its impact on environmental degradation.

The positive relationship between GDP per capita and the per capita GDP of carbon dioxide in the selected countries of the oil exporter can be attributed to the inefficiency of the production sector and the lack of access to advanced technology in this section, given these cases with the advancement of production technology and the modernization of the production sector, it is possible to prevent high pollution from high tech contamination.

A positive relationship between per capita energy consumption and environmental pollution can be partly attributed due to the high energy use in the commercial and home sectors and in transportation, in which energy efficiency is not optimized in these sectors. With this in mind, energy consumption optimization policies and raising the level of people's awareness of environmental hazards can prevent energy consumption from contaminating the environmentKeywords: Economic development, environmental pollution, good governance, the Petroleum Exporting Countries selected, panel data -

Pages 159-200Introduction

Economic growth has been tied to the growth of fuels consumption like natural gas. The inherent features of natural gas market like its dependence on wellhead price, long-distance transportation costs, gas pipeline systems, economies of scale, non-existence of monopoly market for the end user, large proportion of fixed costs compared to variable costs, relatively low income elasticities, etc., have created different market structures which affect the price (Khaleghi, 2010; Whitesitt, 2005; Mansour Kiaei, 2008). Moreover, extensive governmental interventions in gas pricing, have led to the adoption of diversified pricing systems so that there is not any global gas price (Jensen, 2011; Vafee Najjar, 2008).

The gas market has experienced dramatic changes that began with the liberalization process of the market in the 1980s, the result of which was the creation of a spot market (Jafari Samimi et al., 2007; Manzoor & Niakan, 2011; Apergis, Bowden, & Payne, 2015). This market determines the opportunities offered by firms and investors, especially the opportunity cost of stagnant assets by price detecting. Hence, spot prices estimation that uses behavioral characteristics like mean reversion can be useful in future prices evolution (Hull, 2000).

In financial economics literature, it is thought that mean reversion is a sign of inefficient market, and it runs counter to the assumption of random walk. Exley, Mehta, & Smith (2004) state that mean reversion is not necessarily a sign of inefficiency in the market. They believe that it could be due to risk aversion or return distribution over time. Since the world's most mobile gas market, which determines the basic price of the gas exchanges in other countries, including Iran, is located in the U.S. Henry Hub, this hub is being mentioned here.MethodologyDepartures from normal price spreads are possible in the short run under abnormal market conditions, but in the long run, supply will be adjusted and the prices will move to the level dictated by the marginal cost of production. The basic theory of microeconomics states that in the long run, the price of an energy commodity must be related to its long-run marginal cost (Begg & Smith, 2007; Rahimi, 2008). In this paper, we analyze mean reversion, which was first described by Vasicek (1977) and was subsequently widely adapted.

Mean reversion is a normal logarithmic diffusion process, but its variance is not proportional to the incremental time intervals. The variance initially grows and then stabilizes in a certain amount (Geman, 2005; Wittig, 2007). This process has contains two components: the first one indicates drift with rate of mean reversion speed and equilibrium long run mean, and the second component of this process is diffusion term and shows its randomness.Results and DiscussionThis paper aims at mean reversion verification, estimating Ornstein-Uhlenbeck Mean Reverting Model (OUMRM) and forecasting gas daily prices based on Henry Hub data (07/01/1997-20/03/2012). Using different mean-reverting statistics like Unit-Root, autocorrelation coefficients reveal that price returns of natural gas prices do not follow a random walk process. Therefore, there can be a sign of mean reversion. The non-decreasing gradual correlation coefficients of returns indicate that the historical information available in long-term lags can be effective in determining future prices like information in the short-term lags.

The results show the existence of mean reversion using the methods of linear regression and maximum likelihood. The long-run mean price is 4.16 $/mmBtu and it takes the market around 48 weeks to remove daily price shocks. Finally, it is observed that performance evaluation criteria are highly dependent on the number of random simulation paths and the best performances are satisfied with 1000 simulation paths mean.ConclusionEnergy price changes and volatilities have led to an increase in the uncertainty and potential value of predicted prices. Hence, providing models for accurate prediction of natural gas prices with regard to its characteristics like mean reversion is important because it can be applied to determine a wide range of regulatory decisions both on the supply and demand sides of the market. The results of this study is similar to Geman (2007), Skorodumov (2008), Cheong (2009), and Chikibvou and Chinhamu’s (2013) studies and reveas that the existence of the mean reversion phenomenon varies depending on the length of the study period.

Moreover, because of the mobility and transparency of information in gas markets in recent years, as returning to the recent periods, the mean reversion speed becomes higher. It shows higher adjusting speed of mean reversion and faster removal of price distortion caused by shocks. In addition, the more we approach to the recent years, the more long-run mean price is. This implies that investors and traders are expecting a surge in prices and the price volatility in the prices above long-run mean is higher than the prices below it. Therefore, these achievements in determining the behavior of this commodity can lead to a reduction in risk and a great help in predicting the path of the price of long-term contractsKeywords: Natural gas, spot price, Mean reversion, Ornstein-Uhlenbeck Model -

Pages 201-223In this study with pay attention study of effect of investing own education and training in economic growth of selected development countries like ( Iran, Bulgaria, Peru, Romania, Thailand, Turkey, Melissa, Argentina, Brasilia, chili and Mexico) with the use of panel data of 2015 to 2005

The result said studying discusses the positive effect of investment in education and training on economic growth of selected development countries. Also low education expenditure and as a result of this regarding the effect of education and training on skilled labor force is the most important factor of levering economic growth in developing countries. Their for it is better with paying attention to increasing young population in developing countries and the needs of these countries to growth and increasing of production and from other side they should pay attention to the increasing of quality of education and training with increasing the expenditures of education training. Extended AbstractIntroductionThis study investigates the impact of investment in education on economic growth of selected developing countries in the period (1999-2015) using the panel data approach and using education al expenditures data in both primary and secondary levels. Today countries are seeking to improve the quality of their labor force because they believe that more producing is dependent to qualified labor force in this respect, the education represents the most important kind of human investing that predisposing deeper view to production improvement. The most economics believe that the lack of investment in human capital is main cause of low economic growth in developing countries and until the education of these countries does not improve the use of knowledge and the professional skills . the efficiency of labor force and capital remains at a low level and economic growth will be slow and more costly in fact we can say that the physical capital will be more productive only if the country has enough amount of human capital.so to explain the impact of growth on poverty and analyses usefulness of growth, it is necessary to incorporate all the possibilities that enhance well- being of the poor. However, it is really hard to do .so the major capacities, which lead to improve the quality of life, should be giving education. Without any doubt we can say one of the main access growth and economic development is training and education. Even some people believe that the completion of this sectors can complete other sectors. Economic growth in addition to production factors (labor, capital .land) depends on bitterness on quality of workforce’s technical growth better resource allocation and in the last education and training. Theoretical Framework.

This study investigates the impact of investment in education on economic growth of selected developing countries in the period 1999-2015 using the panel data approach and using education expenditures data in both primary and secondary levels the most important problem in the human capital –economic growth nexus is that why human capital can’t play its role in increasing economic growth in natural resource abundance countries . There are tests for chaos in time series such as correlation dimension .BDS. Methodology. - For the purpose of this study the following question was posed. Whether how the countries are seeking to improve the quality of their labor force because they believe that more producing is dependent to qualified labor force today, countries are seeking to improve the quality of their force because they believe that more producing is dependent to .qualified labor force . In this respect, the education represents the most important kind of human investing that predisposing a deeper view to production improvement. . one approach to look at the impact of growth on education is to compare called pen’s parade to see whether it is pro poor it needs to calculate the growth rate in the mean of the poorest quintile.

Results and Discussion.

The results show that the coefficients of the model variables are significant at the 99percent confidence level. In addition the – statistic indicate significant at of regression. The value of R2 statistic indicates that the model fitting insinuates factory condition. The coefficient of education al expenditures in primary and secondary is positive and is 17 and 21 percent. Respectively. Also the coefficient of capital stock and labor force is positive and significant and is equal to 42 and 27 percent respectively. So we can say that the impact of economic reform policies imitated by the government during that period improved the poverty situation in Iran, this must be by education. We can say that the impact of economic reform policies initiated by the government during that period improved the education situation in Iran and according to the finding s of this paper economic growth is good for poor peopleKeywords: investment education, training, human capital, economic growth, developing countries. -

Pages 225-249IntroductionThe choice of exchange rate regimes has always represented a significant challenge for all countries and has been evolved significantly over the years, because, choosing exchange rate regime can play a crucial role in the current and future situation of economy in any country by affecting many economic variables. Furthermore, an exchange rate regime has an important impact on macroeconomic policies within developing countries. The key advantage of fixed exchange rate is their role in reducing transaction costs. Meanwhile, a major disadvantage relates to the fact that in a world where there are implications regarding wages and prices, the benefits from reduced transaction costs, can diminish the importance of costs by a more volatile output and employment level. A second issue relates to whether the exchange rate regime provides protection against financial shock or financial imbalances and monetary policy independence. Under a fixed exchange rate regime, monetary policy is coordinated, and can provide effective protection against fluctuations in monetary joint bid, but not to variations in specific countries. Under floating exchange rates, fluctuations in specific countries could be offset by an independent monetary policy (Fejzaj, 2014).

Theoretical Framework

Standard theory suggests that the choice between a regime of fixed and floating exchange rate should be guided by the desire to minimize inconsistencies in the level of output and employment. Theories of exchange rate regime choice can be grouped under three broad headings: the OCA theory initiated in the early 1960’s, the political economy theory and the currency crisis (capital account openness) approach. OCA theory suggests that the balance of advantages and disadvantages between fixed and flexible exchange rates varies according to the manner and extent of economic integration between countries. In essence, it relates the choice of an exchange rate regime to some structural characteristics, criteria or properties that are relatively stable over time. The political economy theory of exchange regime choice was developed mainly from the concept of “time inconsistency” first introduced by Kydland and Prescott (1977). This stand of literature emphasizes the role of credibility and political factors in the choice of an exchange rate regime. According to the currency crisis or the capital account openness hypothesis countries are (or should sooner or later be) moving to the corner solutions. They are said to be opting either,, on the one hand, for full flexibility, or, on the other hand, for rigid institutional commitments to fixed exchange rates, in the form of currency boards or full monetary union (Daly, 2007).MethodologyIn order to study the choice of the exchange rate regime, it is necessary to employ the proper classification of exchange rate systems. The vast majority of previous studies have attempted to explain exchange rate regime choice as self-reported by countries in the IMF’s annual report on Exchange Arrangements and Exchange Restriction, in this study such methods are employed, too. From a technical point of view, given that the dependent variable (the exchange rate regime choice) is a qualitative variable that can assume two or more values according to the different theoretical hypothesis, Probit models are used. Our analysis of the potential determinants of exchange regime choice involves many of the explanatory variables that have been suggested by theory and used in previous studies.Results and DiscussionIn this study, we begin by estimating binary probit models dividing the sample into floats and pegs. Before turning to the regression analysis, we examine the correlation matrix for the potential determinants of exchange rate regimes. We begin by using only structural (OCA) variables and macroeconomic variables as regressors, then we introduce in turn political variables. A positive sign of a coefficient means that an increase of the associated variable raises the probability of adopting a flexible exchange rate regime. The results show that OCA factors are effective in choosing exchange rate regimes in tow groups. Also, economy size, inflation rate and financial development increase the probability of choosing a flexible exchange rate regime and economic development, while trade openness and monetary shocks reduce the probability of choosing it. Based on the results, we can say that, economic development in both groups of developing countries have the greatest influence in the choice of fixed exchange rate regime. Moreover, trade in lower middle income countries and monetary shocks in upper middle income countries, have the least influence on the choice of a fixed exchange rate regime.

The results from multinomial probit regressions, are completely in line with our previous findings. Indeed, in the majority of estimations, the coefficient of the variable have the same sign. Conclusions and Suggestions

This study aims to examine the effective factors of exchange rate regimes in developing countries, upper and lower middle income, during 2014-1990 using the logit and probit models. In general, the prevailing theories in Exchange Rate Regime are the optimal Exchange area OAC, the theory of political economy and Exchange crisis hypothesis which in this research focuses on OCA theory and political economy approach. Our estimations show that the variables suggested by the optimum currency area and political economy approach are adequate and robust predictor of exchange regime choice in the developing countries. In general, the determination of an exchange rate regime somehow represents a difficult choice for developing countries that still face economic issues and are seeking the best solutions to absorb crises negative effects. Thus, macroeconomic analyses would be needed to better face the economic, fiscal and monetary changes.Keywords: Exchange Rate Regimes, Developing Countries, OAC theory, Logit -

Pages 251-274IntroductionThe devaluation of an economy and currency substitution(CS) are monetary dimensions, which are usually is faced by developing countries, including Iran. CS occurs when the domestic currency of a country cannot perform its functions and is substituted by a foreign money will. CS The has different effects on all economic factors, including households, firms, and the government, and has caused crises in developing countries in recent decades. This phenomenon weakens the national (domestic) currency of a country, either formally (with the will of the government) or informally (without the will of the government). Due to high inflation rates especially in recent years, this phenomenon is still increasing and, therefore, it is necessary to consider its effects on welfare. A major measure to evaluate the welfare of a society is private consumption. This study examines the effects of CS on welfare through its effects on private consumption.

Theoretical frame work

This study examines the welfare effects of currency substitution (CS) through the impact of the degree of CS on private consumption. Individuals convert currency into different assets under inflation conditions. There are several reasons why this conversion occurs. Some people attempt to take advantage of these assets, while others want to eliminate brid of the opportunity cost of holding money. Therefore, they are willing to put money in various courses, including bonds, stocks, foreign currency (especially dollars), long-term saving deposits, and real assets such as durable goods, estate, and tenement. In this study, since the goal is examining the welfare effects of CS, and CS is the replacement of domestic currency with foreign currency (dollar), then it is necessary to examine only the impact of this asset from among others. Generally, no information is available for determining the exact amount of dollars in circulation. An approximate method is the estimation of the amount of dollars in circulation using Kamin and Ericsson’s (2003) method. Kamin and Erickson used a new method to estimate the amount of dollars in circulation. They added the maximum inflation rate(indicative devaluation of the domestic currency) to the function of money demand. Then the formula was used to estimate the amount of dollars in circulation, in which the coefficient of the maximum inflation rate is used. Afterwards, the degree of CS is obtained. Finally, the effect of CS on consumption is estimated.MethodologyBefore using time-series variables in the studies, it is necessary to determine whether they are stationary or non-stationary. If the time-series variables are not stationary, there may be a problem known as the false regression. In this study, the generalized Dickey-Fuller (ADF) test was employed to perform a single root test, and Schwartzbisin (SBC) statistics was utilized because the observation volume is less than 100. Here, variables are the co- integration of the first order, that is, they are stationary with the first-order difference. Consequently, to estimate the real liquidity demand for money in Kamin and Ericsson’s method and estimate the effect of the degree of CS on private consumption, the Johansen- Juselius co-integration approach is used.Results and DiscussionOne of the normalized vectors of co integration in terms of significance is acceptable. Results showed that the coefficient of the degree of CS as an independent variable in the consumption function is significant and negative. In fact, CS affects private consumption and the welfare of individuals, that is, the degree of CS reduces private consumption and welfare.

Conclusions and Suggestions

The results demonstrated that CS influences consumption because CS is meaningful in the function of consumption and its sign is negative. In fact, increasing CS reduces private consumption and also decreases welfare. Due to the negative impact of CS on consumption, monetary and financial authorities are obligated to make decisions to manage and reduce the degree of this phenomenon. These decisions may include the following:Real interest rates are negative in Iran for most years. Therefore, controlling the rate of inflation is a way to prevent having a negative real interest rate .

Risk and uncertainty are high in Iran's financial markets. The reduction of risk can help financial markets to become more attractive.

Providing new financial instruments to attract liquidity to the economy like new Islamic financial papers is recommended.

Establishing economic and curbing inflation to prevent the speculation on the real assets of durable goods is suggested.

Preventing the extreme fluctuations of exchange rate is recommended.Keywords: Currency substitution, welfare , private consumption, Johansen-Juselius cointegration, Iran -

Pages 275-295By delivering service to establishing reasonable relationships with other industrial, manufactural, agricultural and service sectors through collecting small insurance premiums from insureds and indemnifying them timely. the insurance industry as a non-banking financial institution can raise public and private capitals, and direct and invest on such financial resources efficiently, secure production by entrepreneurs, business owners, and professionals, reduce imports from and dependence upon global markets, and hence lead to economic development. Therefore, identification of the public and private shares of this financial market can have a substantial effect on saving financial resources. Moreover, forecasting of this financial market in respect to insurance premiums chargeable and payable, controlling, and directing such financial resources can help different economic sectors make investments and implement their monetary and financial policies in order to reach their long term economic goals. Therefore, this study has attempted to analyze in addition, forecast insurance market.

With regard to the analysis and identification of the public and private market share of insurance, also the forecasting of this financial market, policy maker can conduct the monetary and financial policies in order to achieve their long-term economic goals. In fact the survey of the chargeable and payable premiums of insurance and then controlling and directing it financial resources, can help different economics sectors.IntroductionInsurance market, which is an important part of financial markets in every country, plays an important role in policy making and applying macro-economic policies. Controlling availability of this financial market and conducting liquidity of insurance market towards different parts of national economics, this market leads to the investigation and transmission of investment to economic institutions and thereby providing future perspectives of economic firms. Given the fact that during a short period of time, shock and the intensity of the movement of liquidity and capital of both the private sector and people of society in transferring from economic parts to non-economic ones are high, the recognition and introduction of information, structure and prediction of short-term market for determining appropriate policies is vital.MethodologyIn this work, having looked at monthly statistics data, the researchers tried to investigate factors affecting the market. It is done by using ARDL and ARMA models. In addition, their relationship will be described and estimated based on the ARDL method. On the other hand, since the prediction of financial market is efficient and stable, we can provide a framework for achieving economic growth and development. Thus, this paper will examine the structural stability of insurance market and forecast its market based on auto regression moving average process. Finally, based on these results, applicable policies will be suggested.Results and DiscussionThe primary duty of this market is providing liquidity for the government, the private, and industry sectors in the form of collecting stagnant savings and the liquidity of private sector in order to finance the long-term investment projects.

Forecasting of this financial market in respect to insurance premiums chargeable and payable and controlling and directing such financial resources can help different economic sectors make investments and implement their monetary and financial policies in order to reach their long-term economic goals.

In other words, the analysis and identification of the public and private market share of insurance premiums chargeable and payable and forecasting them play a dual function in the structure of a free economy. On the one hand, it helps to increase the capital of the government and the private sector, and on the other hand, it helps the secondary market to meet the potential and actual investors. Investigation, controlling and conducting the market can lead to the financial resources of the capital market and investment for development and growth and the policies are planned based on the goals of macroeconomic. Economists believe one of the reasons for the lack of the development of developing countries is the low level of investment. In this regard, the insurance market is the main and important center to attract these savings. Accordingly, we should identify its influential factors in the market, and thus use appropriate policies for the progression and growth of the market.

Achieving the optimal growth and development of economy without mobilization of financial resources in long term is impossible. In this regard, the position and the role of financial market are of high importance.

The insurance market, which is the market of demand and supply of financial resources, can play a vital role when the process of supply and demand of its financial sources is the optimal allocations. The main prerequisite for the optimal allocations of resources in the capital market is the efficiency in their performance.

Conclusions and Suggestions

Thus, policy makers should pay attention to the public and private market share of insurance premiums chargeable and payable, its flourishing growth and to government policies, and control the market, prevent the uncontrolled growth of liquidity, eliminate the cumbersome investment regulations and incentives tax, and finally draw a plan for implementation of economic policies.

In this regard, it is essential that the country's economic managers identify macro-economic variables affecting the market, especially government-controlled variables and how their influence can lead to appropriate policies for the stimulation of the market and growth of economyKeywords: Public, Private Market Share of Insurance, Premium Chargeable, Payable, Forecasting