Comparing Effectiveness of Liquidity Growth on GDP, Private Investment and Employment with Assets Market Bubble

Author(s):

Abstract:

Today one of the major questions in the Iranian economy is that do liquidity injected into the economy more effected productive activities or speculative activities .This study was conducted to compare the effects of liquidity growth on real sector and assets market bubbles in Iranian economy during the period 1994(2)-2012(1). For this purpose, price index of four major assets in Iranian economy (currency, housing, stocks and gold coin) were firstly combined through principal component analysis and one composite index called assets price index was provided. At the second stage, assets price index is estimated by ARDL method and residual change of the calculated equation is considered as bubble component of the assets market (agiotage activities index). At the final stage of the study, the equation of assets market bubble component stands beside production equation, private sector investment and employment. It is estimated within the framework of simultaneous equations through 3SLS systematic method.

The findings of the study indicate that the effect of increased volume of liquidity on the assets market bubble is greater than GDP and investment in private sector during the aforesaid period. Furthermore, increased liquidity has no significant effect on the employment during such a period. Considering the results of the investigation, it is suggested to direct the resources correctly toward the manufacturing sector of the country.

The findings of the study indicate that the effect of increased volume of liquidity on the assets market bubble is greater than GDP and investment in private sector during the aforesaid period. Furthermore, increased liquidity has no significant effect on the employment during such a period. Considering the results of the investigation, it is suggested to direct the resources correctly toward the manufacturing sector of the country.

Keywords:

Language:

Persian

Published:

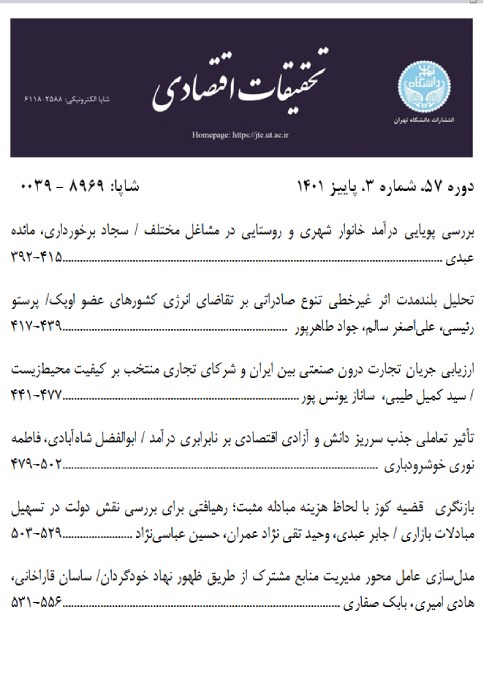

Journal of Economic Research, Volume:51 Issue: 115, 2016

Pages:

457 to 493

magiran.com/p1576460

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!