Designing an Integrated Profit-Risk Model to Optimize the Combination of Bank Resources and Consumptions in Banking Contracts

Author(s):

Article Type:

Research/Original Article (دارای رتبه معتبر)

Abstract:

Providing facilities in the form of bank contracts increases the bank's income and survival, but this should not reduce the bank's ability to respond to depositors, nor should it increase the risk of overdue receivables, as these are factors that can lead to the bankruptcy of the bank or credit institution. Banks are more successful in this space, having a better strategy for combining their resources and consumption. In this research, a linear programming model is presented to identify the optimal combination of resources and expenditures of the bank with simultaneous attention to increasing revenues and reducing risks. Therefore, this research is quantitative and applied. The necessary data have been gained from the information sources of a sample bank in 2018. Model variables are facility values that are paid in the form of various contracts and the method of data analysis, modeling and programming is linear. The results of the research determined the optimal values of each facility and these results were compared with real figures. Also, the level of risk for each loan was determined and finally the parameters of the model were analyzed sensitively. The results of solving the linear programming model showed that the optimal values are significantly different from the real values in qarz al-hasan, mudaraba and ju’alah. Also, the interest rates of conditional lease facilities, predecessor facilities and debt purchase facilities have the largest role in the bank's income. Applying this model can reduce unemployment resources, increase income and reduce the risk of overdue receivables in the bank. Even in cases where the bank is making a loss, this model can minimize the loss and at the same time reduce the likelihood of the bank going bankrupt.

Keywords:

Language:

Persian

Published:

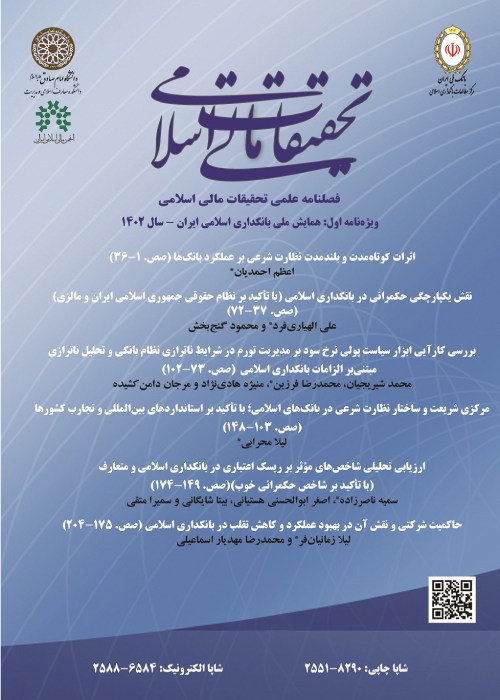

Islamic Financial Research, Volume:10 Issue: 19, 2021

Pages:

39 to 66

magiran.com/p2335109

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!