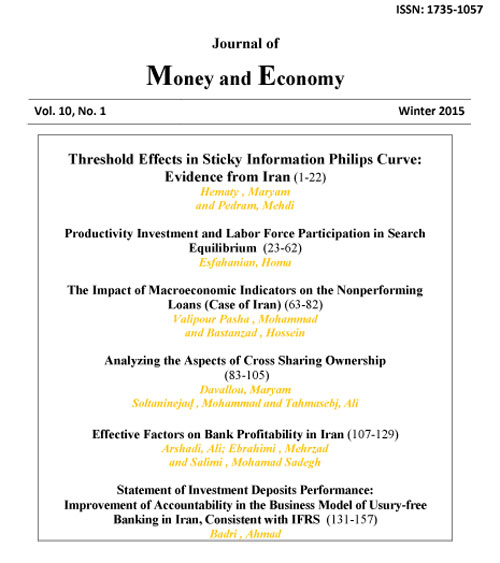

فهرست مطالب

Journal of Money & Economy

Volume:10 Issue: 1, Winter 2015

- تاریخ انتشار: 1395/05/10

- تعداد عناوین: 6

-

-

Page 1During the last decade, several studies have argued that sticky information model proposed by Mankiw and Reis (2002), in which firms update their information occasionally rather than instantaneously, explains some stylized facts about the inflation dynamics. Sticky information pricing model successfully captures the sluggish movement of aggregate prices in response to monetary policy shocks. Despite the importance of sticky information, no empirical studies have been done yet to estimate sticky information Philips Curve (SIPC) and its key parameter - the degree of information rigidity - in Iran. This paper is the first attempt to estimate the degree of information stickiness in Iran using the two stage empirical approach proposed by Khan and Zhu (2006). Having the correct structural parameter allows a better understanding of the dynamics of inflation. Results show that the average duration of information stickiness ranges from 3.2 to 4 quarters in Iran. In addition, the existence of threshold effects in SIPC is also tested in this paper. Based on the estimation of TAR model over 2002Q2- 2015Q1, firms update information faster when inflation is higher. This evidence suggests that firms are more aware of macroeconomic conditions when inflation is higher; that is, missing information during high inflation periods is costly.Keywords: Degree of information stickiness, Sticky information Philips Curve, Out of sample forecasting, Threshold model, Bootstrap

-

Page 23The present paper contributes to the theoretical analysis of the human capital investment and participation decision of heterogeneous workers in the search and matching framework. Its aim is to characterize the equilibrium and to identify the efficiency. Here, the paper studies search equilibrium and matching to consider the participation decision of heterogeneous workers who have different inherent ability levels. The productivity investment decision is endogenous and wages are determined by the Nash bargain among participants.Keywords: Education, Participation, Efficiency, Hold, up problem

-

Page 63Financial statements of nineteen mature banks have been patronized to examine the impact of macroeconomic indicators and bank-specific determinants on the NPLs ratio through Quantile and Panel Data regression approaches. The impact of macroeconomic indicators on credit risk is statistically estimated for banking network via two directions. First, different quantiles are econometrically calculated, assessed and compared during 2007-12. Second, the Panel Data estimation is utilized in the same way to verify the outcomes of quanitle regression and to check the robustness. Results indicate that the impact of real money supply on the banks NPLs in 25%, 50%, and 75% of data is positive and significant in line with empirical evidence. The coefficients of the other variables (including the ratio of individual banks performing loans to total deposits, individual banks performing loans to total loans ratio, as well as GDP would be positively significant as well. The real interest rate has negativelysignificantly driven NPLs. The banks NPLs are generally exacerbated by the impact of higher real money supply over the long run, real interest rate in the money market and upper return in the assets market mainly because of the negative-inflationary transmission effect.Keywords: Nonperforming loans, Macroeconomic indicators, Quantile regression, Panel data

-

Page 83With the growth of capital market, the shareholding structure of companies has become more complex. Direct ownership is easily recognizable through companies shareholders information, however with the formation of cross shareholding among companies, a kind of indirect and complex shareholding has emerged which is not observable. The primary owners (original owners) can take over other companies through intermediate owners. In this research a model is presented to identify and investigate the structure of indirect ownership. Identifying the hidden ownership relations together with determining the level of complexity of network and the degree of ownership concentration are among the capabilities of this model. To this end, the ownership network of Tehran Stock Exchange in June 2014 was analyzed. The results indicate that over 86 percent of all observed ownership relations have been formed by indirect ownership and at least with the presence of one intermediate owner. Moreover, 15.35 percent of the markets total value (equals with 547 thousands billion Rials) was calculated twice and also studying the degree of concentration of ownership indicates that over 60 percent of the markets total value belongs to only 10 percent of the shareholders.Keywords: Cross shareholding, indirect shareholding, Ownership concentration JEL Classifications: L16, G32

-

Page 107Not only in Iran, but throughout the world, banks and banking industry are considered as very important parts of the economy. This study seeks to investigate the impact of the internal characteristics of banks, the structure of the banking industry and the economic situation of Iran on the profitability of the banking system of Iran by exploring the theory of the Structuralism school concerning the impact of structure on profitability. To this end, data relating to 18 private and public banks of Iran during 2003 to 2012 are analyzed by using panel data methods. First, the profitability of the banking system is calculated using relevant indicators; and then, the impact of various internal, structural and environmental factors on bank profitability is evaluated. The results show that internal factors - the amount of capital and the size of the bank - have a positive impact on profitability. Besides, structural factors including market share and concentration are shown to have a positive impact on profitability whereas ownership appears to have no significant impact. Furthermore, inflation and economic cycles among environmental factors exhibit a positive impact on profitability.Keywords: The banking industry of Iran, Profitability, Return on assets, Structuralism theory

-

Page 131Statement of investment deposits performance is a separate and supplementary financial statement that is designed with twoObjectives1. Improvement in the level of disclosure and accountability of the banks to the owners of investment deposits as the main providers of the banks resources, and 2. Implementation of the IFRS standards on banking business in Iran. In this paper, the principles governing the banking business in Iran, and statements of the conceptual framework proposed by the Joint Working Group on IASB and FASB have been combined in order to provide a supporting framework for designing this financial statement. Materiality, comprehensiveness, comparability, maintaining the intrinsic relationship between financial statements, and concordance with the business model are the main features being considered in the design of the supplement. Moreover, the introduction of this financial statement provides some evidence in support of a concept, so called "reasonable flexibility" of universal conceptual framework for financial reporting .Keywords: Accountability, Usury, free Banking Business Model in Iran, Statement of investment deposits performance, Conceptual framework for international financial reporting, Financial statements