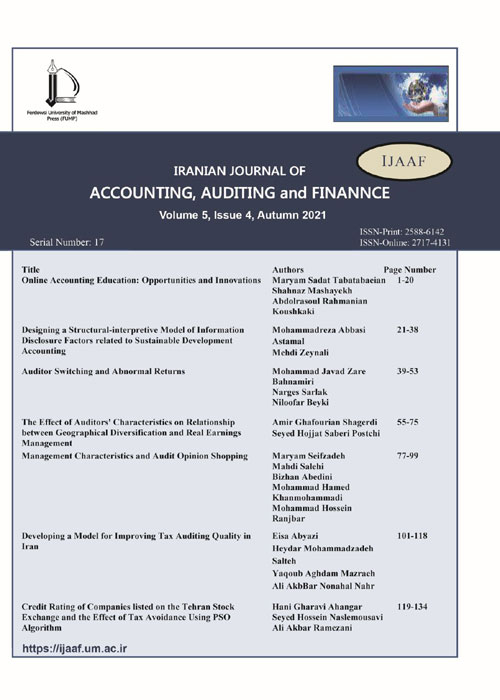

فهرست مطالب

Iranian Journal of Accounting, Auditing and Finance

Volume:5 Issue: 4, Autumn 2021

- تاریخ انتشار: 1400/10/27

- تعداد عناوین: 7

-

-

Pages 1-20The spread of the COVID-19 pandemic and the need for online teaching methods in accounting education have led to changes in training in this field. Despite its many challenges, online education has provided an opportunity to revolutionise the quality, effectiveness, and efficacy of education. Before the COVID-19 pandemic, many researchers had already discussed the opportunities provided by online education. This study uses qualitative content analysis to determine the factors, conditions, and changes provided in online accounting education from the perspective of accounting professors to improve accounting education in Iran. The interviews with 17 accounting professors showed that online accounting education in Iran has created opportunities and led to innovations classified into nine main categories and can be the start of a more general change in accounting education and a step toward improving its quality.Keywords: Online Education, Covid-19, Opportunities, Innovations, Accounting Professors

-

Pages 21-38The current study aims to design a structural-interpretive model for disclosing information related to sustainable development accounting in 2020-2021. Qualitative data were obtained through the study of research and credible sources in the field of sustainable development accounting with content analysis approach and in the form of 4 dimensions (environmental, social factors, economic factors and leadership) in the form of 12 variables using fuzzy Delphi method and matrix questionnaire to determine Pairs of variables were compiled and provided to experts. The study's statistical population includes 25 experts in sustainable development accounting. The data obtained from the questionnaire were analysed using a structural interpretive model and drawn at six levels in an interactive network. Also, these variables' influence and degree of dependence on each other in the influence-dependence power matrix were examined. According to the output of the interpretive structural model, the variables of products and services provided and corporate governance are level one or the most basic elements of the model and the variables of strategic approach to the environment and promotion of moral awareness as the level six variable and the most influential model variable. This study indicates that by disclosing information related to sustainable development accounting factors, managers and policymakers can provide more transparent information to stakeholders by formulating appropriate policies and standards in sustainable development accounting, which leads to social welfare and environmental protection. For future generations, capital market growth and increasing the quality of reporting will ultimately lead to the sustainable performance of companies in the long run.Keywords: Accounting, Sustainable development, Structural-interpretive Model

-

Pages 39-53

Every investor pays special attention to the main factor in their decisions: a return. What is essential for users of financial information is not the procedures and principles used in accounting, but the exit from the financial system, because it helps them achieve their goals. Many capital market concerns focus on accounting and auditing operations. Therefore, the auditor's independence is the basis of public trust in the audit process and the assurance of auditors` reports. For this purpose, this study investigates the effect of auditor switching on abnormal returns. Therefore, three hypotheses have been formulated, and a sample consisting of 365 companies listed on the Tehran Stock Exchange during the years 2010 to 2020 has been selected. The results indicate that auditor switching has no significant effect on abnormal returns. Also, between the CU switch and CD switch, the CD switch has a negative and significant effect on abnormal returns.

Keywords: Abnormal Return, Auditor Switching, Behavioral Finance, Six-factor model Fama & French -

Pages 55-75the study investigates the effect of auditors' characteristics on the relationship between geographical diversification and real earnings management in the listed companies on the Tehran Stock Exchange. Thus, 204 companies listed in Tehran Stock Exchange were systematically selected between 2012- 2017, and the data were analysed using SPSS 24. This research is applied, and in terms of nature, it is an ex-post-facto research, namely, it is based on past (corporate financial statements) analysis. In this study, examining the positive relationships between geographical diversification and real earnings management were shown, respectively. By measuring the effect of auditor’s specialisation on the relationship between geographical diversity and real earnings management, the auditor's expertise's impact has been considered significant, and the second hypothesis was confirmed.Keywords: auditor characteristics, geographical diversification, real earnings management

-

Pages 77-99

The present study assesses the relationship between management characteristics (management entrenchment, narcissism, CEO overconfidence, board effort, real and accrual-based earnings management) and audit opinion shopping in the Tehran Stock Exchange-listed firms. In other words, this paper seeks to answer the question "whether management characteristics can exert a favourable effect on audit opinion shopping or not." For this study, the multivariate regression model is used for hypothesis testing. Research hypotheses are examined using a sample of 1309 observations on the Tehran Stock Exchange during 2012-2018 and by employing the panel data-based multivariate regression and fixed-effects model. The results show a negative and significant relationship between management entrenchment and managers' overconfidence and audit opinion shopping. A positive and meaningful relationship was observed between management narcissism, real and accrual-based earnings management, and board effort and audit opinion shopping.

Keywords: Management entrenchment, CEO Overconfidence, real, accrual-based earnings management, audit opinion shopping, board effort -

Pages 101-118

Given the importance of taxes and tax revenues in the country's economic development, it is crucial to provide a comprehensive model for tax auditing quality. The primary purpose of this study is to design a comprehensive model of tax auditing quality through a mixed method. The qualitative part approach is based on data-based theory. Data collection instruments were semi-structured interviews with 20 partners of auditing firms, managers of the Iranian Association of Certified Public Accountants, and tax officials selected by snowball sampling and content analysis methods. The axial category of the tax auditing quality model was developed, and the final model was presented according to the causal conditions, contextual conditions, intervening conditions, strategies and consequences. In the quantitative part, research hypotheses were developed, and a questionnaire was designed to test them. The questionnaires were filled by 335 experts who did not participate in the qualitative part, and the hypotheses were tested using the structural equation method. Auditing Quality improvement model was developed, which included two major parts, including auditing service providers and auditing services recipients by discovering and identifying strategic factors, intervening (contextual) conditions and their implications along with contextual conditions.

Keywords: Tax Auditing Quality, Systematic Approach, structural equations, qualitative research -

Pages 119-134

Credit ratings reflect the relative ability of companies to meet their financial obligations, the relative default probability, and the recovery probability if the debt is not paid. Credit rating agencies build their information analysis on financial statements, which directly affect the credit rating. Tax activities, meanwhile, may contain useful information for credit rating agencies due to their essential role in influencing corporate credit. Thus, the study aims to investigate corporate tax avoidance's effect on credit rating using the Particle swarm Optimization (PSO) algorithm. Therefore, to achieve the research goal, 101 sample companies were collected in 9 years from 2011 to 2019. The emerging-market scoring model measured credit rating and tax avoidance using two scales of tax-book difference and effective tax rate. The Statistical test related to the results indicates relationships. It is significant between tax avoidance and credit rating.

Keywords: Credit ranking, Tax avoidance, PSO algorithm