فهرست مطالب

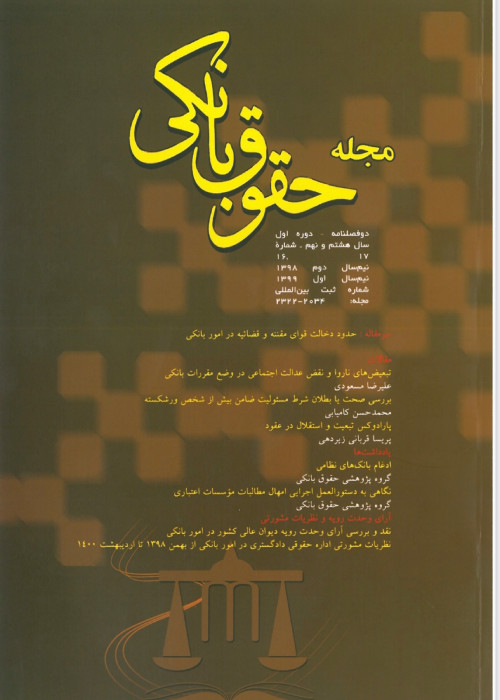

مجله حقوق بانکی

پیاپی 12 (پاییز و زمستان 1396)

- بهای روی جلد: 100,000ريال

- تاریخ انتشار: 1401/06/20

- تعداد عناوین: 11

- سرمقاله

- مقاله

- یادداشت ها

-

صفحه 127

- قوانین و مقررات

-

Page 13

According to existing regulations, guaranty could be performed in both forms of bank guarantee and endorsement. Guarantees have a specific mechanism and clear regulations but endorsement still is not able to seek a position in banking operations. Endorsement is made in the form of guarantee in commercial documents and naturally shall be governed by the rules of commercial documents. Although endorsement has a simpler and clearer mechanism and also farther advantages, thus, it is not used in the banking system. Promulgating the application of this mechanism would also make banking services more various, and it is more desirable for banks to adduce some of the objections.

Keywords: Endorsement, Guaranty, Commercial Documents, Banking Operations -

Page 31

The main feature of bank guarantees and letter of credits which are issued in order to secure the payments in international obligations is “The Independence”. Independence in these documents means that the beneficiary’s right to receive the payment is only determined with referring to the terms and conditions of the same document, and the bank is contented to the strict compliance in letter of credit and the statement of misfeasance in bank guarantees by the beneficiary and it is not necessary to depend the payment on the main transaction or the underlying document. This principle in back to back credits and counter guarantees divulges itself in a more complicated manner because of the existence of complicated relations between the parties. It requires more consideration and more precision because in addition to the existence of the mentioned independence, in back to back credits and counter guarantees, both documents of the both instrument are independence of each other and they play independently, although they are issued relying on one another.

Keywords: Bank Guarantees, Letter of Credits, Strict Compliance, Statement of Misfeasance, International Obligations -

Page 73

During time money has undergone many changes yet due to the proportional relative stagnation of these developments in the twentieth century, a fixed and specific concept for money publishing by central bank is provided which is backed by political economical credit and potency of governments. The emergence of digital currencies has faced this concept with a serious challenge and there are a lot of jurisprudence and legal issues has been raised according to that, whether to consider the crypto currency as money or as goods, though, It is a reality of today’s economy and also in jurisprudence and legal approach there are no important and attentionable objects regarding to it.

Keywords: Crypto Currency, Bitcoin, Money, Central Bank, Property