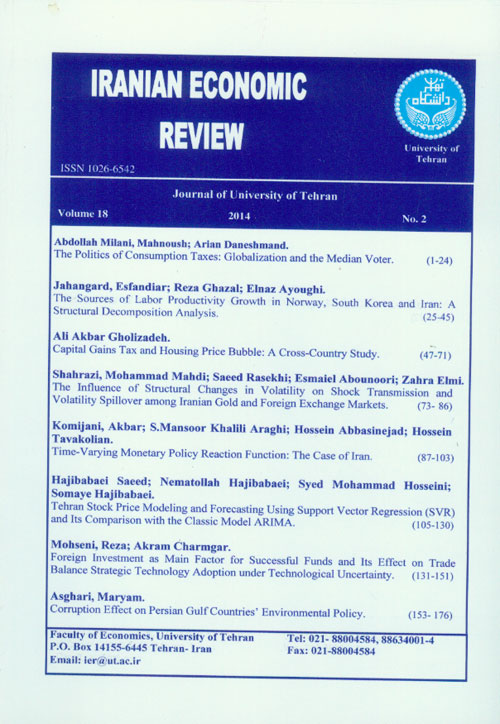

فهرست مطالب

Iranian Economic Review

Volume:18 Issue: 37, Spring 2014

- تاریخ انتشار: 1393/12/10

- تعداد عناوین: 8

-

-

Pages 1-24The regressive nature of consumption taxes poses a challenge to partisan theory. Using data for up to 20 OECD countries in the period 1970-2003 this article aims to explore the question of whether the idea that social democratic governments typically have to compromise on policy goals and core constituency interests to make themselves more appealing to the median voter necessitates the use of regressive consumption tax policies. The results suggest that the position of the median voter determines the actions of social democratic governments regarding regressive consumption taxes when globalization is pronounced.Keywords: Consumption Taxes, economic globalization, Social Democracy, Median Voter

-

Pages 25-45In this paper,using a structural decomposition analysis (SDA) and the latest available input-output tables we investigate the sources of labor productivity growth in Norway, South Korea and Iran. Then, the contribution of each source in the growth of labor productivity is discussed. The results show that among six factors, value added coefficient is the most influencing factoracross all three countries regardless of the level of development. In contrast, labor input coefficient shows the smallest effect on labor productivity growth.Keywords: labor productivity, structural decomposition analysis (SDA)

-

Pages 47-71Policy makers in housing sector seeks to use instruments by which they can control volatility of housing price and prevent high disturbances of the bubble and price shocks, or at least, reduce them. In the portfolio and speculation theories, it is emphasized that speculative demand for housing is the main cause of shocks and price volatilities in the sector. The theory of housing price bubble also describe the dominance of speculative demand and importance of asset demand in the composition of housing demand as the main cause of housing price shocks. Therefore, capital gains tax, which is used in most developed countries, is regarded one of the strong instruments to control and direct housing speculation to minimize damages to the sector. In this study, an attempt has been paid to investigate the effect of capital gains tax on housing prices using panel data for 18 countries (including Iran) over the period from 1991 to 2004. The results show that the efficiency of capital gains tax in countries with capital gains tax system is higher than that of countries lacking the system. In all estimated equations, the real capital gains tax and its share of total tax, contribute significantly to the stabilization of housing prices and controlling housing price volatility. The intermediate objectives of monetary policy, including pegged interest rates and liquidity play a significant role in achieving the ultimate goals of monetary policy such as the housing price bubble and inflation. In addition, the prices of assets have been among the factors affecting housing prices in countries under study.Keywords: Capital Gains Tax, Price Bubble, Housing

-

Pages 73-86The increasing integration of financial markets has generated strong interest in understanding the interaction between these markets. The direction of shock transmission and volatility Spillover from one market to another may affect by structural changes in volatility. However, a shortcoming of traditional GARCH models is that ignore these structural changes. This study investigates the effect of structural changes in volatility on shock transmission and volatility Spillover among Iranian gold and foreign exchange markets during 2007-2013. For this purpose, first we detect the time points of structural breaks in volatility of gold and exchange rate returns endogenously using the modified iterated cumulative sums of squares algorithm. Then, we incorporate this information to modeling volatility process. The results of applying bivariate GARCH model in off-diagonal BEKK parameterization suggest that volatility spillover among Iranian gold and foreign exchange markets is bidirectional but shock transmission is unidirectional from the gold market to the foreign exchange market. Based on findings, ignoring structural breaks in volatility mislead the researcher about the dynamics of shocks and volatilities among these two important markets.Keywords: Structural Changes, Volatility, Shock Transmission, Spillover Effect, Modified ICSS Algorithm, GARCH Process

-

Pages 87-103In this paper, we consider the estimation of a time-varying parameter monetary growth rate reaction function for monetary policy in Iran. In order to deal with implicit inflation targets and time-varying parameters, a two-step procedure is employed in estimation of the time-varying monetary policy reaction function. Considering a monetary policy reaction function with stable coefficients, we first estimate the implicit target values of inflation using Kalman filter procedure. Then, using the estimated inflation targets and explicit targets in the Development Plans, DPs, we estimate two versions of the time-varying parameter monetary policy reaction function to show the difference between what has been done and what should be done to achieve target values of the DPs. Our empirical results reveal that there has been no commitment to the target values of inflation during the first, second and fourth DPs, while the third DP was relatively successful in achieving its targets. The estimated time-varying response of monetary growth to both inflation and output gap suggests that the central bank should have reacted more forcefully to both inflation and output gap in order to achieve the targets of the DPs. The conduct of the monetary policy in recent years has been diverging from what should be done in achieving the targets of the DP.Keywords: Time, varying monetary policy, Kalman filter, Inflation targets, Development Plans

-

Pages 105-130Use of linear and non-linear models to predict the stock price has been paid attention to by investors, researchers and students of finance and investment companies, and organizations active in the field of stock. Timely forecasting stock price can help managers and investors to make better decisions. Nowadays, the use of non-linear methods in modeling and forecasting financial time series is quite common. In recent years, one of the new techniques of data mining with support vector regression (SVR) has had successful application in time series prediction. In this study, using support vector regression model, we examined the Tehran Stock prices and the predicted results were compared with ARIMA classic model. For this purpose, of the Tehran stock companies, 5 companies were selected during the years 2002 to 2012. Using benchmarks to evaluate the performance of MSE, MAE, NMSE these two methods were compared and the results (in the case of non-linear data) indicate the superiority of SVR model compared to the ARIMA model.Keywords: stock investment, stock price forecasting, data mining, support vector regression, ARIMA models

-

Pages 131-151National wealth funds have initiated their activities comprehensively over last two decades. National wealth fund is a governmental investment fund financed by surpluses of payments’ balance, official foreign currency operations, revenues of privatization, payments for governmental transfers, fiscal surpluses and export revenues. However, the financing for this investment requires foreign currency reserve where management of current account’s balance plays important role. First of all, some explanations are presented in this paper about national development fund and then in regard to the study made about successful funds which used foreign investment (direct or indirect) as investment strategy, we will consider the foreign investment. Next, regarding the role of the fund in trade balance and its effect on foreign investment, we will consider the relationship between fund and trade balance in short-term and long-term. Results shown that many successful funds prevented formation of possible corruption following the weakness of institutions to designate fund for inner sectors. Therefore, increase in foreign investment cause positive condition of trade balance in Iran. Whereas China is a new emerged economy with positive trade balance, investment in this country and formation of better relationship and cooperation provide privileges for this country.Keywords: foreign investment, national development fund, trade balance

-

Pages 153-176Environmental regulation has proceeded at different paces in different countries of the world. These differences are particularly pronounced between developing countries, and have given rise to much controversy and debate on the influence of corruption on environmental policies in an open economy (see, e.g., López and Mitra 2000; Fredriksson et al. 2004; Barbier et al. 2005).1 The causes and effects of corruption have been discussed extensively in the literature (see, e.g., the surveys by Bardhan 1997; Jain 2001; Aidt 2003). We explore the joint effects of corruption level and energy efficiency (a major form of environmental policy). The paper discusses the prescription of Persian Gulf countries’ environmental regulations over 1990-2012. We find that corruption level is the most important factor in explaining the variance in the region environmental policies and higher levels of the region corruption will lead to low stringent environmental policy.Keywords: Corruption, Environmental Policy, Persian Gulf Region