Explaining Dynamics of Current Account in Iran's Economy and Determining its Propulsives in a New Keynesian DSGE Model

Author(s):

Article Type:

Research/Original Article (دارای رتبه معتبر)

Abstract:

In Keynesian viewpoint, the relation between current account with national saving and investment and also financial deficit of government is calculatable from fundamental relation with GDP in an open economy. Meaning that the difference between National savings and investments is equal to the country's trade surplus. With the separation of the amounts of national investments and savings in sectoral levels, using account of current funds, evaluating the scale of participating of any of the important economic sections in causing surplus/deficit in commercial balance will be possible. Using Iran's flow of funds accounts, we found that during 1972-2013, Iran's average annual current account to GDP Ratio is %.7(surplus) which is the summation of %-1.4(deficit) in government net borrowing to GDP, %3.7 and %.4 (surplus) in household and financial sectors net lending, respectively. We also determine the main determinants of Iranian current account using DSGE model in which all shocks are separated in two categories: domestic shocks (including monetary, fiscal and productivity shocks) and foreign shocks (including oil price shock, foreign demand and inflation shocks). After the Model parameters are estimated by Bayesian estimation using 1990-2014 Iran quarterly data. The results show that the foreign shocks explain more than 50 percent of current account variance in all temporal horizons. Oil price and global inflation shocks are two main deriver of current account in this category of shocks. Fiscal shocks is also the main determinant of current account movements in domestic shocks category which is in line with our finding in flow of funds account analysis. Altogether, the foreign shocks effect on current account is more persistent than domestic shocks.

Keywords:

Language:

Persian

Published:

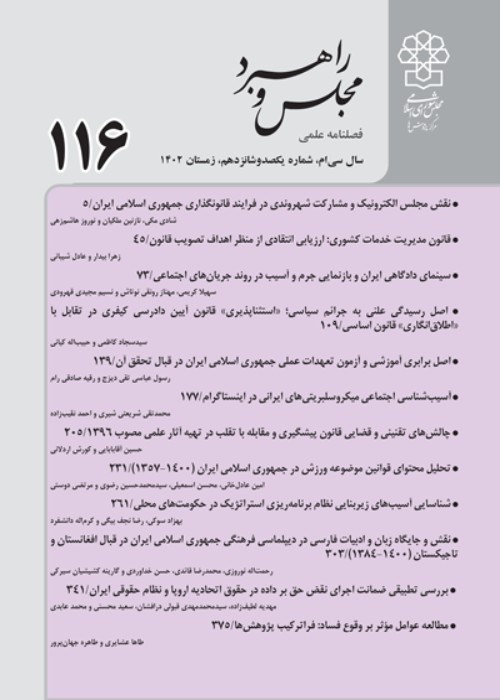

Majlis and Rahbord, Volume:24 Issue: 92, 2018

Pages:

363 to 404

magiran.com/p1781370

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!