A New Paradigmatic Model for an Efficient and Effective Regulatory Governance in Iranian Banking Network

Author(s):

Article Type:

Research/Original Article (بدون رتبه معتبر)

Abstract:

With regard to the need for improving international relations, exchanges and cooperation in the Iranian banking system after lifting the sanctions, banking supervision is expected to enhance and implement the latest banking standards and requirements so as to facilitate the engagement of foreign banks and investors in the country, which in turn would pave the way for Iranian involvement in the international arenas. This will not be realized unless legal, institutional and regulatory measures are taken within the banking system aimed at building a proper business environment. This study attempted to develop a conceptual model for regulatory governance over Central Bank of Iran in line with enforcement of the 20-Year Vision and the general policies of Resilience Economy. The methodology is based on a qualitative approach as well as Grounded Theory. The statistical population consists of 21 experts and specialists familiar with the banking and regulation literature selected through a judgemental sampling approach. In this study, data were collected using semi-structured interviews. Then, the data were analyzed through a coding technique derived from Grounded Theory using Atlasti. Finally, the dimensions of the new model were explained. The reliability and validity of the data were obtained through participant review and non-participant expert review, which were highly reliable. The core theme of this study was resilient regulatory governance, the dimensions of which were explained with regard to the causal and mediator conditions. Then, the strategies were developed and final model was presented. At the end, it was suggested that a resilient regulatory governance should be implemented through revising the laws and regulations, establishing the banking codes and regulation, designing an integrated financial policy system, institutionalizing an integrated financial policy system, reforming the banking sector, strengthening the banking supervision and expanding an appropriate banking conduct based on prescriptions of the Central Bank.

Keywords:

Language:

Persian

Published:

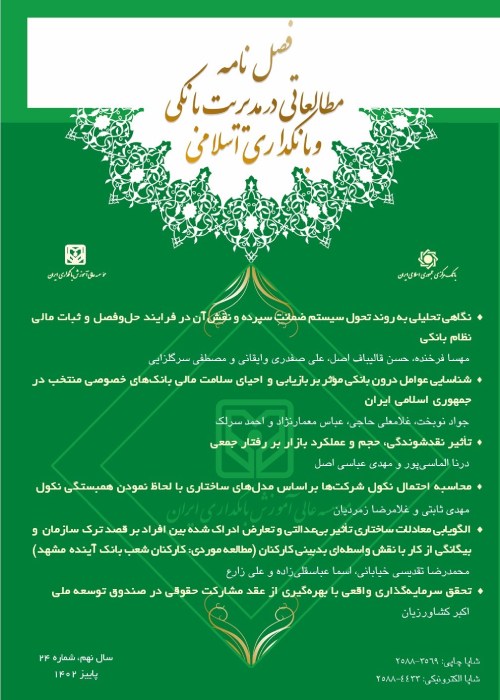

Journal of Studies in Banking Management and Islamic Banking, Volume:2 Issue: 3, 2016

Pages:

63 to 93

magiran.com/p1967730

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!