The Effect of Financing Structure on Insolvency Risk of Banks

Author(s):

Article Type:

Research/Original Article (بدون رتبه معتبر)

Abstract:

Insolvency risk of banks accounted for a large part of the banking literature, especially after the global financial crisis and the subsequent widespread bankruptcies of the banks is of great importance. Most banks and credit institutions face with financial insolvency due to the lack of portfolio diversification of financing structure, lending large amount of loans to a particular industry or economic sector, and the lack of management and control of risks before they come into existence. Since the failure of the financial sector especially banks undermine public confidence in the financial system and as a result devastating effects is transferred on the entire economy, studying factors influencing the risk of insolvency is very important. Hence, the present study uses panel data model (unbalanced panel) and Generalized Least Squares (GLS) to test the effectiveness of the financing structure, credit risks, interest rate risk on insolvency risks of banks. Research data include financial information of 10 commercial public banks, private, and privatized banks under Article 44 during the priod of 2001 to 2012. The results show that specialization financing structure variable has a significant and direct effect on the risk of bank insolvency, while financing structure stability variable over the medium term (mid-term policy of banks lendings) has reverse and significant effect on the risk of bank insolvency. Also, the effect of interest rate risk, credit risk and liquidity risk on bank insolvency risk is significant and positive.

Language:

Persian

Published:

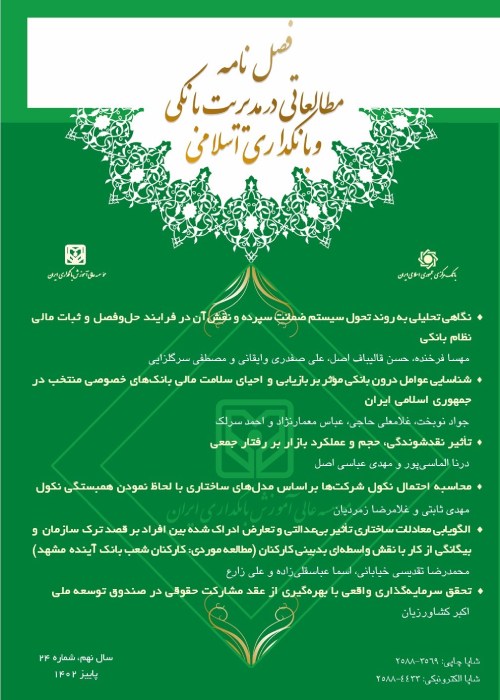

Journal of Studies in Banking Management and Islamic Banking, Volume:1 Issue: 2, 2016

Pages:

1 to 27

magiran.com/p1967741

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!