فهرست مطالب

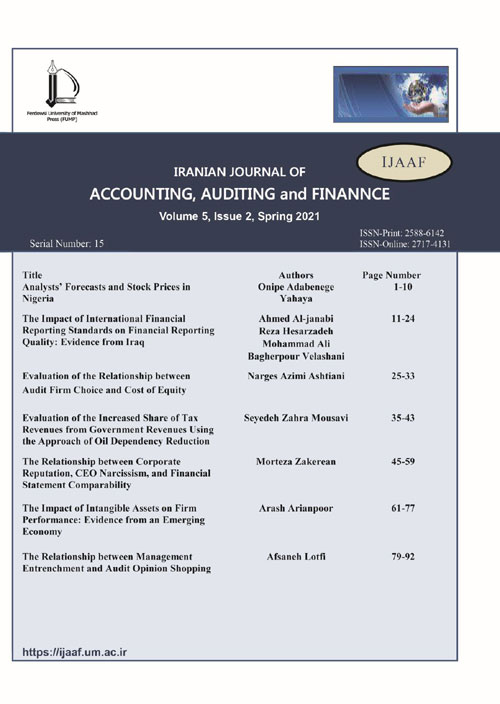

Iranian Journal of Accounting, Auditing and Finance

Volume:3 Issue: 1, Winter 2019

- تاریخ انتشار: 1399/12/19

- تعداد عناوین: 7

-

Pages 1-12

After behavioral finance was introduced, disagreements arose between advocates of behavioral finance and the efficient-market hypothesis. The two financial areas were regarded as contradictory by experts in the profession. In contrast to the prevailing view, it seems that the two approaches are not at odds. Therefore, this paper aims to address these two financial areas through a moderate approach. The present study examined works existing in finance using the analytical-critical method and finally extracted the concept of “market behavior efficiency” through deductive reasoning. Accordingly, the present research's prevailing view states that “at any point in time, the degrees of concepts presented in the efficient-market hypothesis and behavioral finance prevail in the stock market,” influencing the prices. This paper concludes that the market price of any financial asset is composed of three components: producers’ cost (primary cost or value); the effect of investors’ proper reaction to the right and bad news about the firm issuing the financial asset; and the effect of investors’ improper responses to the available information (i.e., the effect of investors’ errors when making decisions). An analysis of the prevailing conditions in a market and factors influential on forming its available assets provides a vital insight into how related officials, domestic and international investors act. So, it brings about outcomes for determining investment strategies and academic literature.

Keywords: Efficient-Market Hypothesis, Behavioral Finance, Market BehaviorEfficiency -

Pages 13-27

In this study, we investigate the problems and obstacles to implementing risk-based auditing in Iran. We set four hypotheses and used a questionnaire containing 45 questions to collect the required data. The questionnaires were distributed between Iranian certified public accountants who were partners or directors of audit firms and audit organizations member of Iranian certified public accountant institute. A limited number of questionnaires were distributed between a small sample of respondents to determine the research questionnaire, and their views are taken into account. Cronbach's alpha test is used to measure the reliability of the questionnaire. The results of this study indicated that lack of the theoretical foundations and regulations of risk-based auditing in Iran, structure and function of auditors and audit firms, and factors related to the clients are the obstacles and limitations on the implementation of risk-based auditing in Iran Then the most critical factors prioritized using fuzzy hierarchy analysis. For this reason, a questionnaire was developed with 16 factors from approved hypotheses. Results revealed that related factors with the auditors and unfamiliarity of auditors with IT, and lack of educational resources were the most significant obstacles and limitations to implementing the risk-based auditing in Iran.

Keywords: limitations on the implementation of risk-based auditing, auditors, employers, rules, regulations -

Pages 29-45

The practical aim of the paper is to examine whether CEO turnover occurs under account-level and company-level internal control material weaknesses (ICMWs) in Tehran Stock Exchange (TSE) or not. The authors utilized data from 99 Iranian firms' financial statements as the sample over 5 years (2013-2018). A total of 594 observations were analyzed using a logit regression model. Empirical findings revealed there is no significant relationship between account-level and company-level ICMWs with CEO turnover. Therefore, establishing appropriate internal control is not merely dependent on the CEOs but may require committed staff withholding strong moral values. This paper develops the literature and generates empirical evidence of the relation between CEO turnover and ICMWs in Iran's specific context as a developing country.

Keywords: Internal Control Material Weaknesses (ICMWs), Account-level InternalControl, Company-level Internal Control, CEO turnover, TSE -

Pages 47-59

Services are an essential central element of the economy in today's societies, and banks, as one of the essential service organizations, direct and support many of the community's economic activities. This study aimed to develop an optimal model for East Azarbaijan banks' performance based on organization risk management using the standardized questionnaire of Kosovo 2017. To achieve this purpose, the director or assistant director, head or deputy head, bank managers, and experts of banks were selected for statistical sampling. The structural equation modeling approach was used to estimate the model and tests. Organizational risk management factors, including "written job descriptions and resources to describe personnel duties, fraud risk assessment concerning how management and other employees participate," was assessed as factors affecting bank performance. Therefore, the banking system's structural problems should be resolved to function and develop in the future. Consequently, to resolve the banking system crisis, it is necessary to reform the banking system.

Keywords: Banking Performance, Enterprise Risk Management (ERM) -

Pages 61-73

The disclosure of executive compensation arrangements in annual reports would allow investors and other interested parties to make informed judgments about manager motivation and commitment to maximize shareholder wealth. This study examines the relationship between Executive cash compensation, corporate governance, Income smoothing, Discretionary accruals, and firm value in companies listed on the Tehran Stock Exchange. The statistical population of this study is Iran-Tehran Stock Exchange during 2013-2017. The results showed that Corporate Governance has a Negative and Significant Impact on Executive cash compensation. Executive cash compensation does not significantly negatively affect income smoothing, and Executive cash compensation does not have a positive and significant effect on Discretionary accruals. And, Executive cash compensation has a significant impact on decreasing Firm value.

Keywords: executive cash compensation, corporate governance, income smoothing, discretionary accruals -

Pages 75-96

Timeliness in financial reporting is so crucial that it is mentioned in the conceptual accounting framework as qualitative characteristics of accounting information. This research tries to consider a new attitude in accounting research in audit report lag and audit fees. The study used the data from listed companies on the Tehran Stock exchange during 2009 -2015. The findings show a significant relationship between audit report lag and variables including type of audit firm, number of Basis for Modification Paragraphs, audit opinion, and ROA. Also, there is a significant relationship between audit fees and variables, including audit firm change during the fiscal year, type of audit firm, number of the basis for modification paragraphs, CEO’s educational degree, and company size. The current study results may give more information about the fluctuation of audit fees in developing nations.

Keywords: CEO’s ethnicity, audit report lag, audit fees -

Pages 97-111

The present study aims to evaluate the relationship between audit quality, risk-taking, and value creation. The population under study is the listed companies on the Tehran Stock Exchange. The study covers 1764 company-year from 2005-2016. This study is based on the panel data and multivariate regression method. Fixed and random effects methods employed to estimate the regression. In this paper, five components of audit quality, including auditor specialization, tenure, audit firm size, ownership concentration, and the percentage of unbounded board members, were studied. The results indicate that only tenure and ownership concentration has a significant relationship with companies' value creation among these five components and the risk factor.

Keywords: audit quality, risk-taking, value creation