Identification and Ranking of Islamic Treasury Bill's Risks in Iran's Securities Market

Author(s):

Abstract:

Islamic treasury bills (ITB) in Iran's Securities Market are the latest financial innovation in Islamic financial instruments. They were issued for the first time in Iran's Fara Bourse on 94/8/7. To finance government projects, Iran's Securities Market is extending Islamic treasury bills. So it will be useful to investigate some other aspects of ITB such as risks identification and risks ranking.

This article wants to clarify these questions: what are the risks of ITB and how do they affect ITBs efficiency. At first, we describe these questions by using a descriptive method and then we are going to rank risks by analytical hierarchy process. The results show that the interest rate risks, liquidity risks, inflation risks and exchange rate risks have more probability of occurrence. Furthermore, interest rate risks, liquidity risks, credit risks and inflation risks have more effective impact in the process of issuing IBT.

This article wants to clarify these questions: what are the risks of ITB and how do they affect ITBs efficiency. At first, we describe these questions by using a descriptive method and then we are going to rank risks by analytical hierarchy process. The results show that the interest rate risks, liquidity risks, inflation risks and exchange rate risks have more probability of occurrence. Furthermore, interest rate risks, liquidity risks, credit risks and inflation risks have more effective impact in the process of issuing IBT.

Keywords:

Language:

Persian

Published:

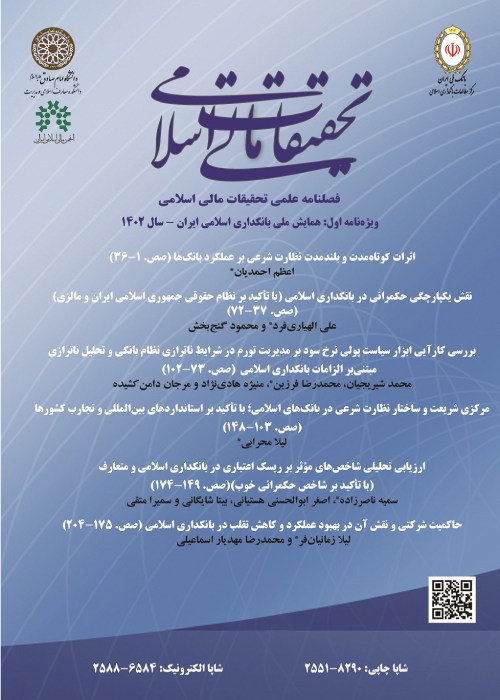

Islamic Financial Research, Volume:6 Issue: 12, 2017

Pages:

133 to 166

magiran.com/p1754469

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!