Prospect Theory; New Approach in Explaining Tax Evasion Phenomenon

Author(s):

Article Type:

Research/Original Article (دارای رتبه معتبر)

Abstract:

Tax evasion analysis is typically based on an expected utility theory (EUT). However, this leads to several qualitative and quantitative puzzles. Literature on tax evasion, it is believed that increasing the tax rate, the tax evasion also increased. So why dont most of taxpayers evade? There is not enough evidence to prove the above results. In this paper, using the theory by Kahneman and Tversky prospect that was first introduced in 1979, to consider the problem of tax evasion. Compare the results of the calculation of tax crimes, using both theories states that there is big difference between the perspective theory and the theory of expected utility. Crimes obtained obtained by using the theory of expected utility are much larger . Prospect theory with regard to behavioral factors governing the decision to study the behavior of tax payers states as well.

Keywords:

Language:

Persian

Published:

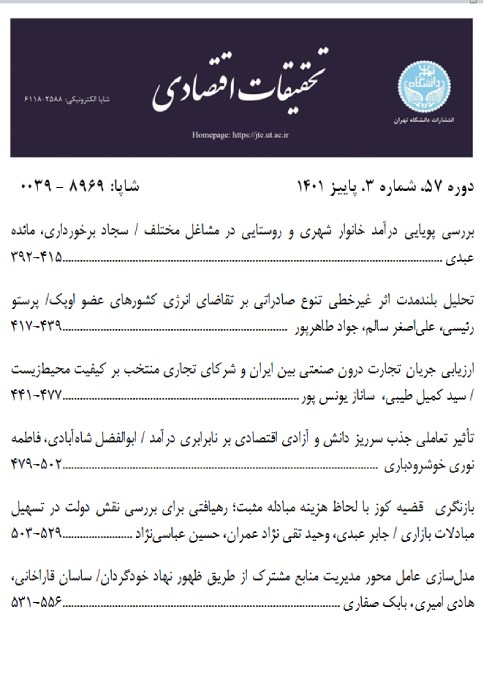

Journal of Economic Research, Volume:53 Issue: 122, 2018

Pages:

1 to 23

magiran.com/p1804069

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!