Tax Procedure in Iran (Structure, Strategic Principles, Problems and Difficulties)

Author(s):

Article Type:

Research/Original Article (ترویجی)

Abstract:

In the taxation process occurrence of dispute between tax-payer and tax authority is something probable and quite natural. There are some references for tax dispute settlements, other than public courts. In tax dispute usually it is tried to settle the disputes through administrative formalities, otherwise they are referred to the first reference available, and that is "Tax Dispute Settlement Board". After this stage, there are some other references such as "High Council of Taxation" and "Administrative Justice Court" that deal with it on technicalities. Although the main purpose of this study is to shed light on different stages of tax trial and statutes in chronological order, it has been tried, also, to have an eye on the principles of efficient trial and their problems, in the margin. Also the status of Iranian regulations in this regard has been elaborated on.

Keywords:

Language:

Persian

Published:

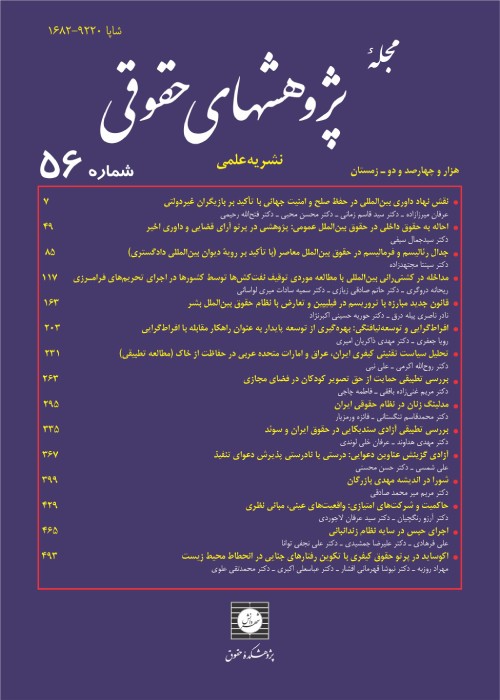

Journal of Legal Research, Volume:5 Issue: 10, 2006

Pages:

255 to 273

magiran.com/p2237546

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!