Modeling the Transmission of Volatility in the Iranian Stock Market Space-State Nonlinear Approach

Author(s):

Article Type:

Research/Original Article (دارای رتبه معتبر)

Abstract:

Using the daily data of the price index of 15 industries during 2016/10/30 to 2021/3/27, the volatility of Iranian stock market has been modeled in this paper. Factor multivariate stochastic volatility model in the framework of space-state approach is the basis for decomposing the stock market volatility into two components, “volatility rooted in latent factors” and “idiosyncratic volatility” and estimating time-varying covariance matrix and dynamic pair-wise correlation of time series. The findings reveal that: first, there are two latent factors; the first affects the volatility of domestic industries (real estate, agriculture, food products, sugar, cement, etc.) and volatilities of commodity-based industries (chemical and petrochemical industries, petroleum products, basic metals and metal products) are affected by the latter. Second idiosyncratic volatilities of each industry increase during this period, and evidence of clustering behavior emerges. Third, the volatility of banking industry’s stock return is influenced by both of latent factors and its idiosyncratic volatility lies in the middle of industries. This finding is logical and predictable because banks lend to a wide range of different industries, so idiosyncratic volatility of this sector and factors loading will be the weighted average of other industries. Fourth, the highest degree of pairwise correlation is observed between the 4 commodity-based industries, which have had an upward trend during this period. JEL Classification: C11, C32, C58, G17

Keywords:

Language:

Persian

Published:

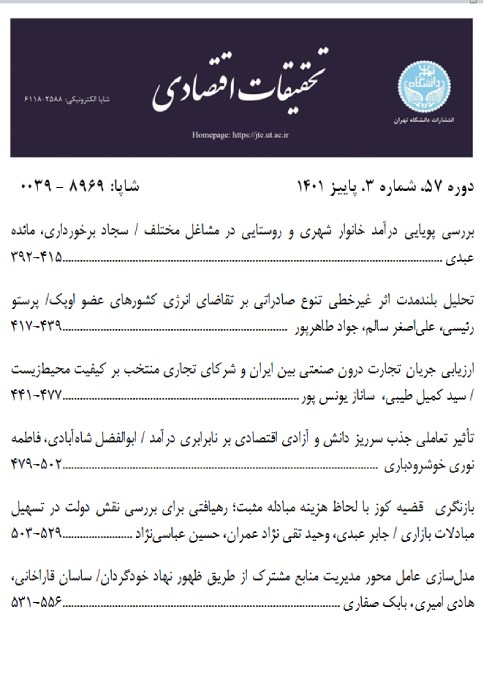

Journal of Economic Research, Volume:55 Issue: 133, 2021

Pages:

963 to 990

magiran.com/p2306785

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!