Analysis of Dependency Structure of Default Processes Based on Bayesian Copula

Author(s):

Abstract:

One of the main problems in credit risk management is the correlated default. In large portfolios, computing the default dependencies among issuers is an essential part in quantifying the portfolio''s credit. The most important problems related to credit risk management are understanding the complex dependence structure of the associated variables and lacking the data. This paper aims at introducing a new methodology for credit risk management based on Bayesian copulas. In this paper, the focus is specifically on a new method of simulating the joint distribution of default risk. This methodology joins the use of copulas and Bayesian models. Using copulas, the joint multivariate probability distribution of a random vector can be separated into individual components characterized by marginal distributions. The model is based on a jump diffusion process for the intensities. Another important problem in credit risk management is the lack of data, which influences the parameter estimation. Considering this drawback, the employment of Bayesian methods and simulation tools could be a natural solution to the problem. This suggests the use of Bayesian models, computed via simulation methods and in particular, Markov chain Monte Carlo. Bayesian methods in Student''s $t$ copula are efficient enough for heavy tail distribution. Moreover, our main outcome is that the application of Bayesian methodology causes a reduction of measure while that copula is Student''s $t$. Finally, the conclusion of Bayesian copulas with classic copulas was compared through a simulation study.

Keywords:

Language:

English

Published:

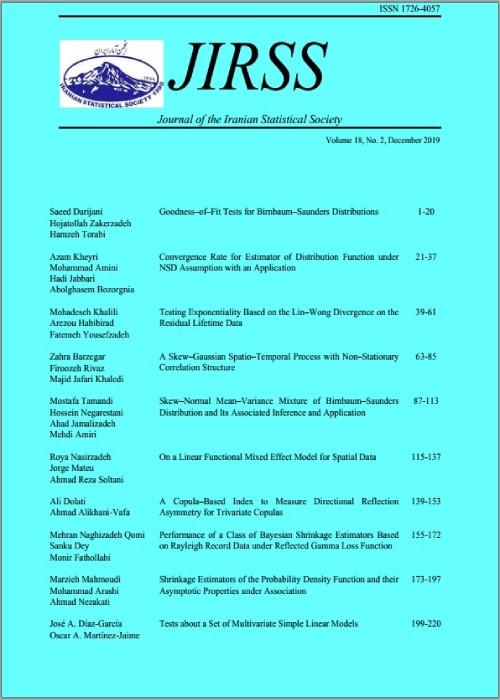

Journal of Iranian Statistical Society, Volume:13 Issue: 1, 2014

Pages:

43 to 56

magiran.com/p1257484

دانلود و مطالعه متن این مقاله با یکی از روشهای زیر امکان پذیر است:

اشتراک شخصی

با عضویت و پرداخت آنلاین حق اشتراک یکساله به مبلغ 1,390,000ريال میتوانید 70 عنوان مطلب دانلود کنید!

اشتراک سازمانی

به کتابخانه دانشگاه یا محل کار خود پیشنهاد کنید تا اشتراک سازمانی این پایگاه را برای دسترسی نامحدود همه کاربران به متن مطالب تهیه نمایند!

توجه!

- حق عضویت دریافتی صرف حمایت از نشریات عضو و نگهداری، تکمیل و توسعه مگیران میشود.

- پرداخت حق اشتراک و دانلود مقالات اجازه بازنشر آن در سایر رسانههای چاپی و دیجیتال را به کاربر نمیدهد.

In order to view content subscription is required

Personal subscription

Subscribe magiran.com for 70 € euros via PayPal and download 70 articles during a year.

Organization subscription

Please contact us to subscribe your university or library for unlimited access!